Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match.

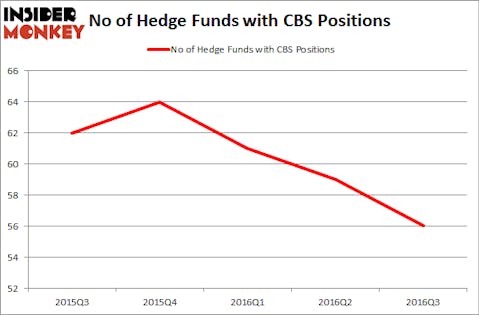

So should one consider investing in CBS Corporation (NYSE:CBS)? The smart money seems to be in a bearish mood. The number of long hedge fund bets fell by three recently. However, since the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives, at the end of this article we will examine companies such as Ventas, Inc. (NYSE:VTR), CRH PLC (ADR) (NYSE:CRH), and DISH Network Corp. (NASDAQ:DISH) to gather more data points.

Follow Paramount Global (NASDAQ:PARAA,PARA)

Follow Paramount Global (NASDAQ:PARAA,PARA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Concept Photo/Shutterstock.com

Now, we’re going to take a peek at the latest action regarding CBS Corporation (NYSE:CBS).

Hedge fund activity in CBS Corporation (NYSE:CBS)

At Q3’s end, a total of 56 of the hedge funds tracked by Insider Monkey were long this stock, down by 5% over the quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Larry Robbins’ Glenview Capital has the number one position in CBS Corporation (NYSE:CBS), worth close to $739 million, amounting to 5.3% of its total 13F portfolio. Coming in second is Chieftain Capital, managed by John Shapiro, which holds a $265 million position; the fund has 15.3% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish include Jonathon Jacobson’s Highfields Capital Management, Kenneth Mario Garschina’s Mason Capital Management and Howard Guberman’s Gruss Asset Management.