Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

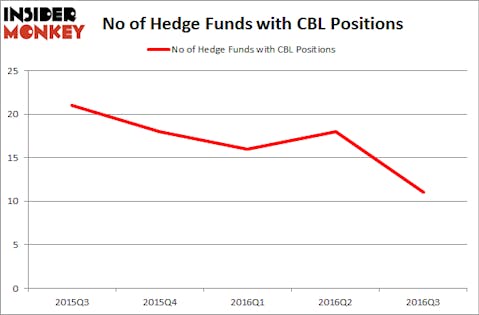

Is CBL & Associates Properties, Inc. (NYSE:CBL) a healthy stock for your portfolio? Hedge funds are unmistakably becoming less hopeful. The number of long hedge fund positions that are disclosed in regulatory 13F filings slashed by7 recently. There were 18 hedge funds in our database with CBL holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Oasis Petroleum Inc. (NYSE:OAS), Vishay Intertechnology (NYSE:VSH), and GW Pharmaceuticals PLC- ADR (NASDAQ:GWPH) to gather more data points.

Follow Cbl & Associates Properties Inc (NYSE:CBL)

Follow Cbl & Associates Properties Inc (NYSE:CBL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Mikko Lemola/Shutterstock.com

Now, let’s analyze the recent action encompassing CBL & Associates Properties, Inc. (NYSE:CBL).

Hedge fund activity in CBL & Associates Properties, Inc. (NYSE:CBL)

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -39% from the previous quarter. By comparison, 18 hedge funds held shares or bullish call options in CBL heading into this year. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Israel Englander’s Millennium Management, one of the largest hedge funds in the world, has the biggest position in CBL & Associates Properties, Inc. (NYSE:CBL), worth close to $19 million, corresponding to less than 0.1%% of its total 13F portfolio. Coming in second is Cliff Asness of AQR Capital Management, with a $4.7 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism contain George Hall’s Clinton Group, John Overdeck and David Siegel’s Two Sigma Advisors and Ray Carroll’s Breton Hill Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that CBL & Associates Properties, Inc. (NYSE:CBL) has gone through bearish sentiment from the smart money, we can see that there were a few money managers who were dropping their entire stakes last quarter. It’s worth mentioning that Jim Simons’s Renaissance Technologies cut the largest stake of the “upper crust” of funds watched by Insider Monkey, worth close to $7.2 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dropped its stock, about $3 million worth.

Let’s now review hedge fund activity in other stocks similar to CBL & Associates Properties, Inc. (NYSE:CBL). We will take a look at Oasis Petroleum Inc. (NYSE:OAS), Vishay Intertechnology (NYSE:VSH), GW Pharmaceuticals PLC- ADR (NASDAQ:GWPH), and Prothena Corporation PLC (NASDAQ:PRTA). This group of stocks’ market values are similar to CBL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OAS | 33 | 638807 | 0 |

| VSH | 17 | 272131 | 3 |

| GWPH | 24 | 801197 | 7 |

| PRTA | 15 | 786215 | 1 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $625 million. That figure was $30 million in CBL’s case. Oasis Petroleum Inc. (NYSE:OAS) is the most popular stock in this table. On the other hand Prothena Corporation PLC (NASDAQ:PRTA) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks CBL & Associates Properties, Inc. (NYSE:CBL) is even less popular than PRTA. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Best Places To Visit in Brazil

Most Ethnically Diverse Cities In Europe

Best Consumer Products In The World