There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Caretrus REIT Inc (NASDAQ:CTRE).

Is Caretrus REIT Inc (NASDAQ:CTRE) a marvelous investment now? Prominent investors are in a pessimistic mood. The number of long hedge fund positions went down by 2 recently. Our calculations also showed that CTRE isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the latest hedge fund action surrounding Caretrus REIT Inc (NASDAQ:CTRE).

How are hedge funds trading Caretrus REIT Inc (NASDAQ:CTRE)?

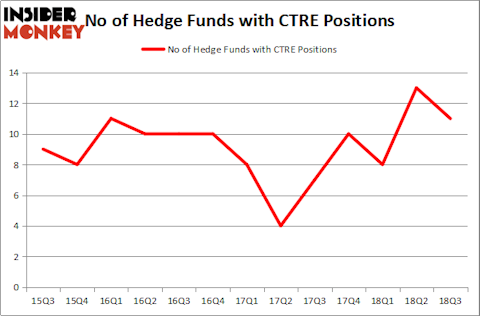

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CTRE over the last 13 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Caretrus REIT Inc (NASDAQ:CTRE) was held by Millennium Management, which reported holding $44.6 million worth of stock at the end of September. It was followed by Carlson Capital with a $39.7 million position. Other investors bullish on the company included Balyasny Asset Management, Driehaus Capital, and Renaissance Technologies.

Judging by the fact that Caretrus REIT Inc (NASDAQ:CTRE) has witnessed declining sentiment from hedge fund managers, logic holds that there was a specific group of hedgies that slashed their positions entirely in the third quarter. Intriguingly, Noam Gottesman’s GLG Partners dumped the biggest position of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $10.9 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund said goodbye to about $0.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Caretrus REIT Inc (NASDAQ:CTRE) but similarly valued. We will take a look at Milacron Holdings Corp (NYSE:MCRN), SPX Corporation (NYSE:SPXC), Warrior Met Coal, Inc. (NYSE:HCC), and Adaptimmune Therapeutics plc (NASDAQ:ADAP). All of these stocks’ market caps are similar to CTRE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCRN | 17 | 58112 | -4 |

| SPXC | 11 | 114731 | 1 |

| HCC | 35 | 495642 | 4 |

| ADAP | 13 | 375496 | -1 |

| Average | 19 | 260995 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $261 million. That figure was $132 million in CTRE’s case. Warrior Met Coal, Inc. (NYSE:HCC) is the most popular stock in this table. On the other hand SPX Corporation (NYSE:SPXC) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Caretrus REIT Inc (NASDAQ:CTRE) is even less popular than SPXC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.