Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Callaway Golf Co (NYSE:ELY) .

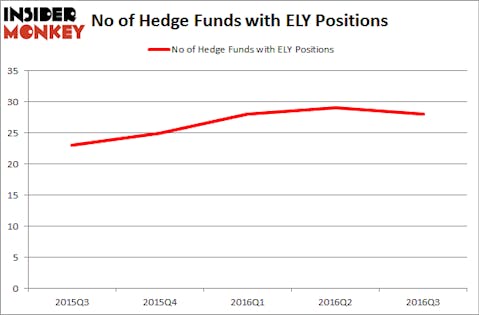

Is Callaway Golf Co (NYSE:ELY) a buy right now? Prominent investors are indeed in a pessimistic mood. The number of long hedge fund positions suffered a reduction of 1 in recent months. ELYwas in 28 hedge funds’ portfolios at the end of the third quarter of 2016. There were 29 hedge funds in our database with ELY positions at the end of the previous quarter. At the end of this article we will also compare ELY to other stocks including First Merchants Corporation (NASDAQ:FRME), Tronox Ltd (NYSE:TROX), and Redwood Trust, Inc. (NYSE:RWT) to get a better sense of its popularity.

Follow Callaway Golf Co (NYSE:CALY)

Follow Callaway Golf Co (NYSE:CALY)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

pixfly/Shutterstock.com

Now, let’s check out the key action surrounding Callaway Golf Co (NYSE:ELY).

How are hedge funds trading Callaway Golf Co (NYSE:ELY)?

Heading into the fourth quarter of 2016, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, down 3% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards ELY over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Alexander Mitchell’s Scopus Asset Management has the biggest position in Callaway Golf Co (NYSE:ELY), worth close to $30.8 million, accounting for 0.5% of its total 13F portfolio. Sitting at the No. 2 spot is Platinum Asset Management, led by Kerr Neilson, holding a $22.5 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism encompass Carson Yost’s Yost Capital Management, Principal Global Investors’s Columbus Circle Investors and Douglas Dethy’s DC Capital Partners. We should note that Yost Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Callaway Golf Co (NYSE:ELY) has faced falling interest from the aggregate hedge fund industry, we can see that there was a specific group of money managers that slashed their full holdings by the end of the third quarter. Intriguingly, Peter S. Park’s Park West Asset Management cut the biggest position of all the hedgies followed by Insider Monkey, valued at about $27.2 million in stock. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also dropped its stock, about $3.2 million worth of ELY shares.

Let’s also examine hedge fund activity in other stocks similar to Callaway Golf Co (NYSE:ELY). These stocks are First Merchants Corporation (NASDAQ:FRME), Tronox Ltd (NYSE:TROX), Redwood Trust, Inc. (NYSE:RWT), and Ascena Retail Group Inc (NASDAQ:ASNA). This group of stocks’ market caps are closest to ELY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRME | 11 | 45400 | 2 |

| TROX | 23 | 152524 | 5 |

| RWT | 11 | 141284 | 0 |

| ASNA | 28 | 174589 | 5 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $140 million in ELY’s case. Ascena Retail Group Inc (NASDAQ:ASNA) is the most popular stock in this table. On the other hand First Merchants Corporation (NASDAQ:FRME) is the least popular one with only 11 bullish hedge fund positions. Callaway Golf Co (NYSE:ELY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ASNA might be a better candidate to consider taking a long position in.

Disclosure: none.