At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Brookfield Property REIT Inc. (NASDAQ:BPYU).

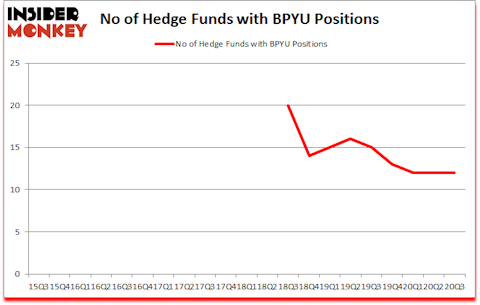

Is BPYU a good stock to buy now? Hedge fund interest in Brookfield Property REIT Inc. (NASDAQ:BPYU) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that BPYU isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). At the end of this article we will also compare BPYU to other stocks including Kelly Services, Inc. (NASDAQ:KELYA), Unisys Corporation (NYSE:UIS), and MGP Ingredients Inc (NASDAQ:MGPI) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a large number of tools stock traders put to use to assess publicly traded companies. A duo of the less known tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can outperform their index-focused peers by a healthy amount (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best blue chip stocks to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s review the key hedge fund action regarding Brookfield Property REIT Inc. (NASDAQ:BPYU).

Do Hedge Funds Think BPYU Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in BPYU a year ago. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in Brookfield Property REIT Inc. (NASDAQ:BPYU) was held by Bulldog Investors, which reported holding $70.8 million worth of stock at the end of September. It was followed by GLG Partners with a $2.4 million position. Other investors bullish on the company included LMR Partners, Millennium Management, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Bulldog Investors allocated the biggest weight to Brookfield Property REIT Inc. (NASDAQ:BPYU), around 22.79% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, setting aside 0.12 percent of its 13F equity portfolio to BPYU.

Since Brookfield Property REIT Inc. (NASDAQ:BPYU) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there were a few hedgies who were dropping their positions entirely last quarter. Intriguingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the largest stake of all the hedgies monitored by Insider Monkey, totaling an estimated $5.4 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dumped its stock, about $1.6 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Brookfield Property REIT Inc. (NASDAQ:BPYU) but similarly valued. These stocks are Kelly Services, Inc. (NASDAQ:KELYA), Unisys Corporation (NYSE:UIS), MGP Ingredients Inc (NASDAQ:MGPI), The Shyft Group, Inc. (NASDAQ:SHYF), Kadmon Holdings, Inc. (NASDAQ:KDMN), Solar Capital Ltd. (NASDAQ:SLRC), and Federal Agricultural Mortgage Corp. (NYSE:AGM). All of these stocks’ market caps match BPYU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KELYA | 9 | 10589 | -2 |

| UIS | 14 | 55912 | -5 |

| MGPI | 11 | 19354 | -2 |

| SHYF | 13 | 71919 | -5 |

| KDMN | 24 | 304665 | -5 |

| SLRC | 12 | 20556 | 0 |

| AGM | 11 | 13712 | 3 |

| Average | 13.4 | 70958 | -2.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.4 hedge funds with bullish positions and the average amount invested in these stocks was $71 million. That figure was $76 million in BPYU’s case. Kadmon Holdings, Inc. (NASDAQ:KDMN) is the most popular stock in this table. On the other hand Kelly Services, Inc. (NASDAQ:KELYA) is the least popular one with only 9 bullish hedge fund positions. Brookfield Property REIT Inc. (NASDAQ:BPYU) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for BPYU is 33. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 32.9% in 2020 through December 8th and still beat the market by 16.2 percentage points. A small number of hedge funds were also right about betting on BPYU as the stock returned 30.3% since the end of the third quarter (through 12/8) and outperformed the market by an even larger margin.

Follow Brookfield Property Reit Inc. (NASDAQ:BPYU)

Follow Brookfield Property Reit Inc. (NASDAQ:BPYU)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.