We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article we look at what those investors think of Boston Properties, Inc. (NYSE:BXP).

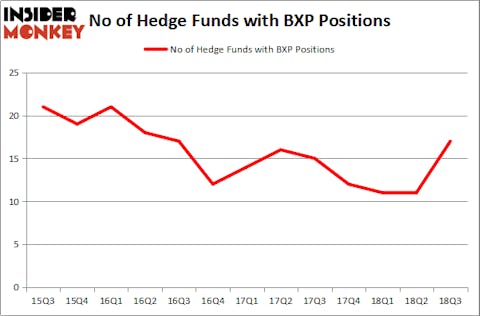

Boston Properties, Inc. (NYSE:BXP) was in 17 hedge funds’ portfolios at the end of September. BXP has seen an increase in enthusiasm from smart money in recent months. There were 11 hedge funds in our database with BXP positions at the end of the previous quarter. Our calculations also showed that BXP isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to check out the fresh hedge fund action regarding Boston Properties, Inc. (NYSE:BXP).

What have hedge funds been doing with Boston Properties, Inc. (NYSE:BXP)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 55% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in BXP heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, AEW Capital Management, managed by Jeffrey Furber, holds the number one position in Boston Properties, Inc. (NYSE:BXP). AEW Capital Management has a $199 million position in the stock, comprising 5.6% of its 13F portfolio. The second largest stake is held by Israel Englander of Millennium Management, with a $38.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers that are bullish include Phill Gross and Robert Atchinson’s Adage Capital Management, Cliff Asness’s AQR Capital Management and Ken Griffin’s Citadel Investment Group.

As industrywide interest jumped, some big names were leading the bulls’ herd. Millennium Management, managed by Israel Englander, initiated the most outsized position in Boston Properties, Inc. (NYSE:BXP). Millennium Management had $38.9 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $9.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, David Costen Haley’s HBK Investments, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks similar to Boston Properties, Inc. (NYSE:BXP). We will take a look at Mylan N.V. (NASDAQ:MYL), Check Point Software Technologies Ltd. (NASDAQ:CHKP), Fifth Third Bancorp (NASDAQ:FITB), and Microchip Technology Incorporated (NASDAQ:MCHP). This group of stocks’ market caps match BXP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYL | 39 | 3249890 | -1 |

| CHKP | 26 | 813840 | 4 |

| FITB | 24 | 444468 | -4 |

| MCHP | 23 | 885716 | -7 |

| Average | 28 | 1348479 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1.35 million. That figure was $348 million in BXP’s case. Mylan N.V. (NASDAQ:MYL) is the most popular stock in this table. On the other hand Microchip Technology Incorporated (NASDAQ:MCHP) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Boston Properties, Inc. (NYSE:BXP) is even less popular than MCHP. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.