The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Bloomin’ Brands Inc (NASDAQ:BLMN).

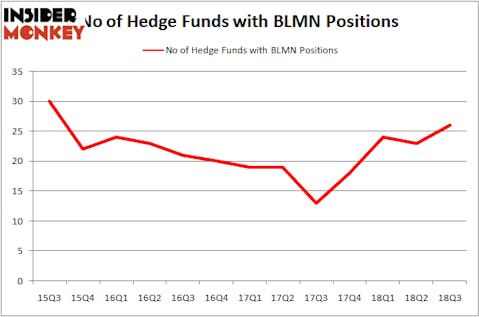

Is Bloomin’ Brands Inc (NASDAQ:BLMN) a healthy stock for your portfolio? Prominent investors are becoming hopeful. The number of long hedge fund positions rose by 3 recently. Our calculations also showed that BLMN isn’t among the 30 most popular stocks among hedge funds. BLMN was in 26 hedge funds’ portfolios at the end of the third quarter of 2018. There were 23 hedge funds in our database with BLMN positions at the end of the previous quarter.

In the financial world there are tons of formulas stock market investors employ to evaluate stocks. Some of the most innovative formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can outclass the market by a significant margin (see the details here).

Let’s take a gander at the key hedge fund action surrounding Bloomin’ Brands Inc (NASDAQ:BLMN).

What have hedge funds been doing with Bloomin’ Brands Inc (NASDAQ:BLMN)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BLMN over the last 13 quarters. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Bloomin’ Brands Inc (NASDAQ:BLMN) was held by Millennium Management, which reported holding $86.5 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $44.9 million position. Other investors bullish on the company included Balyasny Asset Management, D E Shaw, and Tyvor Capital.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Samlyn Capital, managed by Robert Pohly, initiated the largest position in Bloomin’ Brands Inc (NASDAQ:BLMN). Samlyn Capital had $4.7 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also made a $3 million investment in the stock during the quarter. The following funds were also among the new BLMN investors: Benjamin A. Smith’s Laurion Capital Management and James A. Mitarotonda’s Barington Capital Group.

Let’s check out hedge fund activity in other stocks similar to Bloomin’ Brands Inc (NASDAQ:BLMN). We will take a look at Guess’, Inc. (NYSE:GES), NxStage Medical, Inc. (NASDAQ:NXTM), WillScot Corporation (NASDAQ:WSC), and Mueller Water Products, Inc. (NYSE:MWA). This group of stocks’ market values are closest to BLMN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GES | 17 | 81212 | -1 |

| NXTM | 32 | 528339 | 0 |

| WSC | 26 | 261579 | -5 |

| MWA | 16 | 236172 | 0 |

| Average | 22.75 | 276826 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $277 million. That figure was $372 million in BLMN’s case. NxStage Medical, Inc. (NASDAQ:NXTM) is the most popular stock in this table. On the other hand Mueller Water Products, Inc. (NYSE:MWA) is the least popular one with only 16 bullish hedge fund positions. Bloomin’ Brands Inc (NASDAQ:BLMN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NXTM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.