In this article you are going to find out whether hedge funds think Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

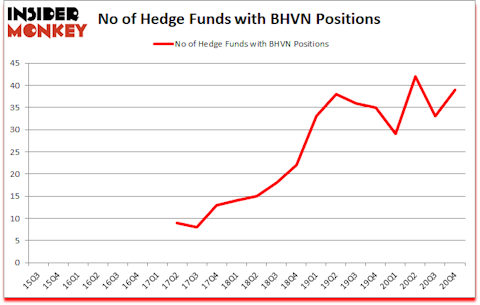

Is BHVN stock a buy or sell? Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) was in 39 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 42. BHVN investors should be aware of an increase in activity from the world’s largest hedge funds recently. There were 33 hedge funds in our database with BHVN holdings at the end of September. Our calculations also showed that BHVN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Mark Kingdon of Kingdon Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s review the fresh hedge fund action regarding Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN).

Do Hedge Funds Think BHVN Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the third quarter of 2020. On the other hand, there were a total of 35 hedge funds with a bullish position in BHVN a year ago. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Marshall Wace LLP, managed by Paul Marshall and Ian Wace, holds the most valuable position in Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN). Marshall Wace LLP has a $219.1 million position in the stock, comprising 1.2% of its 13F portfolio. The second largest stake is held by Kingdon Capital, led by Mark Kingdon, holding a $105.4 million position; the fund has 11.4% of its 13F portfolio invested in the stock. Some other peers with similar optimism contain Fred Knoll’s Knoll Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Steven Boyd’s Armistice Capital. In terms of the portfolio weights assigned to each position Knoll Capital Management allocated the biggest weight to Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN), around 50.11% of its 13F portfolio. Kingdon Capital is also relatively very bullish on the stock, earmarking 11.41 percent of its 13F equity portfolio to BHVN.

Consequently, specific money managers have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, assembled the most outsized position in Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN). Point72 Asset Management had $3.1 million invested in the company at the end of the quarter. Prashanth Jayaram’s Tri Locum Partners also initiated a $1.7 million position during the quarter. The following funds were also among the new BHVN investors: Devesh Gandhi’s SilverArc Capital, Bhagwan Jay Rao’s Integral Health Asset Management, and Donald Sussman’s Paloma Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) but similarly valued. These stocks are South State Corporation (NASDAQ:SSB), BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), Douglas Emmett, Inc. (NYSE:DEI), Eidos Therapeutics, Inc. (NASDAQ:EIDX), Concentrix Corporation (NASDAQ:CNXC), Vertex, Inc. (NASDAQ:VERX), and Alarm.com Holdings Inc (NASDAQ:ALRM). This group of stocks’ market valuations are closest to BHVN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSB | 17 | 176265 | -6 |

| BJ | 25 | 239711 | -6 |

| DEI | 21 | 482154 | -3 |

| EIDX | 22 | 427914 | 9 |

| CNXC | 21 | 406489 | 21 |

| VERX | 11 | 130337 | -4 |

| ALRM | 20 | 374519 | -4 |

| Average | 19.6 | 319627 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.6 hedge funds with bullish positions and the average amount invested in these stocks was $320 million. That figure was $752 million in BHVN’s case. BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) is the most popular stock in this table. On the other hand Vertex, Inc. (NASDAQ:VERX) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) is more popular among hedge funds. Our overall hedge fund sentiment score for BHVN is 87.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Unfortunately BHVN wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on BHVN were disappointed as the stock returned -17.8% since the end of the fourth quarter (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Biohaven Pharmaceutical Holding Co Ltd. (NYSE:BHVN)

Follow Biohaven Pharmaceutical Holding Co Ltd. (NYSE:BHVN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.