The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider Berkshire Hathaway Inc. (NYSE:BRK-B) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

Is Berkshire Hathaway Inc. (NYSE:BRK-B) a sound investment now? The smart money is becoming more confident. The number of long hedge fund positions moved up by 3 recently. Hedge fund managers still have a lot of confidence in Warren Buffett’s stock picks as Berkshire ranks 17th in the list of 30 most popular stocks among hedge funds.

In today’s marketplace there are a lot of gauges stock market investors put to use to analyze their holdings. A pair of the most innovative gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top money managers can outpace their index-focused peers by a significant amount (see the details here).

We’re going to review the key hedge fund action encompassing Berkshire Hathaway Inc. (NYSE:BRK-B).

How are hedge funds trading Berkshire Hathaway Inc. (NYSE:BRK.B)?

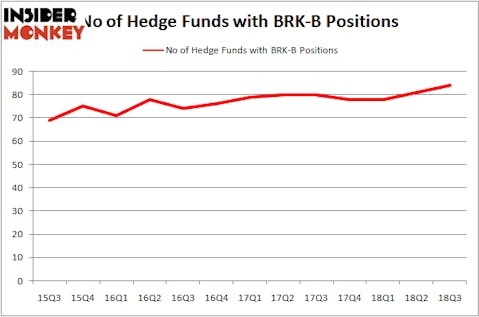

At the end of the third quarter, a total of 84 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BRK-B over the last 13 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Berkshire Hathaway Inc. (NYSE:BRK.B) was held by Bill & Melinda Gates Foundation Trust, which reported holding $13291.7 million worth of stock at the end of September. It was followed by Eagle Capital Management with a $2027.2 million position. Other investors bullish on the company included Gardner Russo & Gardner, Gardner Russo & Gardner, and Water Street Capital.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. GRT Capital Partners, managed by Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk, assembled the most outsized position in Berkshire Hathaway Inc. (NYSE:BRK.B). GRT Capital Partners had $10.6 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $10.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Jeffrey Talpins’s Element Capital Management, Charles Davidson and Joseph Jacobs’s Wexford Capital, and Highbridge Capital Management.

Let’s now review hedge fund activity in other stocks similar to Berkshire Hathaway Inc. (NYSE:BRK.B). We will take a look at Facebook Inc (NASDAQ:FB), Alibaba Group Holding Ltd (NYSE:BABA), JPMorgan Chase & Co. (NYSE:JPM), and Johnson & Johnson (NYSE:JNJ). This group of stocks’ market valuations are closest to BRK-B’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FB | 164 | 16604320 | -29 |

| BABA | 127 | 15116904 | 10 |

| JPM | 99 | 11436176 | 7 |

| JNJ | 63 | 5040704 | -3 |

As you can see these stocks had an average of 113.25 hedge funds with bullish positions and the average amount invested in these stocks was $12050 million. That figure was $24061 million in BRK-B’s case. Facebook Inc (NASDAQ:FB) is the most popular stock in this table. On the other hand Johnson & Johnson (NYSE:JNJ) is the least popular one with only 63 bullish hedge fund positions. Berkshire Hathaway Inc. (NYSE:BRK.B) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FB might be a better candidate to consider a long position.

We also analyzed the historical performance of Warren Buffett’s 13F stock picks and uncovered that Warren Buffett lost his mojo in recent years. That’s why we don’t think BRK-B is a good investment going forward. You can download a free copy of this analysis and report on our site.

Disclosure: None. This article was originally published at Insider Monkey.