Semper Vic Partners LP, an investment management firm, published its second-quarter 2021 investor letter – a copy of which can be downloaded here. A return of 11.0% was recorded by the fund for the second quarter of 2021, outperforming its Dow Jones Industrial and S&P 500 benchmark that delivered a 5.1% and 8.6% return respectively for the same period. You can take a look at the fund’s top 5 holdings to have an idea about their top bets for 2021.

In the Q2 2021 investor letter of Semper Vic Partners, the fund mentioned Berkshire Hathaway Inc. (NYSE: BRK-A) and discussed its stance on the firm. Berkshire Hathaway is an Omaha, Nebraska-based multinational conglomerate company with a $625.8 billion market capitalization. BRK-A delivered a 19.65% return since the beginning of the year, while its 12-month returns are up by 26.57%. The stock closed at $420,801.00 per share on September 13, 2021.

Here is what Semper Vic Partners has to say about Berkshire Hathaway Inc. in its Q2 2021 investor letter:

“Berkshire Hathaway and Nestlé remain key holdings with portfolio weights generally at least 10 percent for Nestlé and 14 percent for Berkshire Hathaway across portfolios. Each are held for specific reasons. Berkshire Hathaway is held because of agency cost. It is my belief that Berkshire Hathaway has the least amount of agency cost of any company I follow. Agency cost is the propensity of managers of public companies to try to whittle away from owners as much intrinsic value as they can for themselves. The main way that this is done involves stock option compensation and collaboration with Wall Street analysts whose time horizon is unnecessarily short-term. I believe that Chief Investment Officers in a large percentage of US-based public companies underinvest for long-term growth, fearing adverse near-term pressure such investments often have on reported earnings.

I believe that agency cost arises mainly in the area of reinvestment decisions. Reinvestment is the engine of the growth that we covet from your holdings. Managements who underinvest to avoid inevitable burden on reported short-term profits, generated by investments intended to deliver long-term growth in intrinsic value, inevitably under-deliver on potential growth.

Berkshire Hathaway’s orientation is just the opposite. Berkshire Hathaway is driven by maximizing, in a risk-reducing manner, long-term wealth on a per share basis. Often, the reason why investments appeal to Berkshire Hathaway has been that they offer maximum growth in reported wealth that is concealed by near-term adverse impact those investments have on reported short-term results. Warren Buffett’s goal is to maximize long-term wealth on a per share basis. His interest in investments increase when great business franchises are available at below intrinsic value due to most investors’ and most companies’ misplaced focus on short-term reported profits.

Berkshire Hathaway’s ability to invest in businesses, even when those investments depress near-term results, has given Berkshire Hathaway advantages over the decades as it assiduously drove investments for growth in intrinsic value on a per share basis. Berkshire Hathaway has evidenced a usual duality in its mindset during our decades of ownership. Berkshire Hathaway has, throughout the years, enjoyed the following two powers – i.e., “the ability to invest in anything” and “the willingness to do nothing.” Since Mr. Buffett has effective voting control over Berkshire Hathaway, he has been able to protect his managers from outsized pressure when their investments to build long-term wealth inevitably depress reported profits. Mr. Buffett seeks

companies with enduring competitive advantages that grow with scale (e.g., historic appeal of Nebraska Furniture Mart and other such companies in Berkshire Hathaway’s fold).Berkshire Hathaway’s intrinsic value on a per share basis has grown as a result of this discipline. See’s Candies, one of Berkshire Hathaway’s earliest investments under Berkshire Hathaway’s ownership, exemplifies the virtues Berkshire Hathaway possesses resulting in their lumpy but large amounts of underlying profits. Berkshire Hathaway was able to purchase See’s Candies at a fair price (e.g., approximately $35 million) in part because the company had one aspect troubling to most investors, See’s Candies only earned money four months of the year due to seasonality. Other potential buyers of See’s Candies would have sought to smooth out earnings across the year in seasons that would have been more conducive to soup (winter) or ice cream (summer). Berkshire Hathaway realized that such efforts would dilute from See’s Candies intrinsic value as a premium confectioner whose products were received warmly as gifts.

Rather than force reinvestment, See’s Candies was acquired as a source of recurring free cash flow. See’s Candies has lived up to its reputation for quality chocolate, generating over $2 billion for Berkshire Hathaway over the years since its acquisition. See’s Candies’ relative lack of reinvestment potential troubled Berkshire Hathaway not a bit. Berkshire Hathaway did not force investments to diversify against low store traffic count during off seasons. Berkshire Hathaway allowed See’s Candies to reinvest to its business’ needs and deployed free cash flow, beyond funding those See’s Candies-related needs, broadly across acquisitions that it funded via Berkshire Hathaway’s handling of See’s Candies cash flow elsewhere.

Berkshire Hathaway has been armed to make attractive investments in companies whose appeal was blurred by low reported profits in some instances because of burden on reported near-term earnings due to reinvestment. They were able to encourage subsidiaries that could reinvest, to do so, even despite burdens such investments would have on reported profits due to their reinvestment to achieve valued intrinsic value growth. At the same time, Berkshire Hathaway was able to steer cash from subsidiaries, for whom none was needed, given inability to profitably deploy additional capital.

Berkshire Hathaway’s valuation, we believe, remains attractive, despite its recent run-up from $245,000 per share to over $415,000 per share. The fact that Berkshire Hathaway shares remain an attractive opportunity for growth in intrinsic value, despite its share price increase, simply suggests how deeply undervalued they were late last year. Since then, Berkshire Hathaway has unleashed its long, latent power to repurchase shares. Berkshire Hathaway has repurchased over $30 billion since January 2019, with acceleration taking place in 2020 and 2021. Repurchases at below intrinsic value on a per share basis has helped Mr. Buffett to secure his desired growth in intrinsic value for remaining shareholders.

I continue to believe that Berkshire Hathaway shares remain meaningfully underpriced, trading at just under $430,000 per share, compared to its intrinsic value on a per share basis of roughly over $525,000. This discount recognizes that Berkshire Hathaway will retain substantial cash at all times (i.e., over $50 billion held safely in US Treasury bills to reassure its reinsured). This Fort Knox-like balance sheet is intended to uphold its view of their insurance customers’ comfort taken from Berkshire Hathaway’s commitment to remain fortress rich in reserves sufficient to meet the worse insurance calamities knowingly underwritten by Berkshire Hathaway. Reassuring funds for reinsurance clients.

Today, we believe Berkshire Hathaway deserves its portfolio position for several reasons. First, the position reflects Berkshire Hathaway’s continuing discount from intrinsic value on a per share basis. Second, the position reflects Berkshire Hathaway’s continued commitment to growth. Third, the position reflects Berkshire Hathaway’s unleashing of share repurchase to further reduce shares outstanding when markets fail to properly assign value to its shares.

Fourth, Berkshire Hathaway has resolved some uncertainty that overhang share price over the past decade with the announcement of senior management changes, naming excellent talent to handle key roles of public market investing and of portfolio oversight of Berkshire Hathaway’s immense wholly owned subsidiaries.”

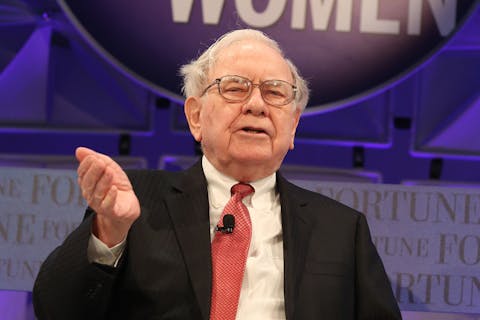

Krista Kennell/Shutterstock.com

Based on our calculations, Berkshire Hathaway Inc. (NYSE: BRK-A) ranks 12th on our list of the 30 Most Popular Stocks Among Hedge Funds. BRK-A was in 116 hedge fund portfolios at the end of the first half of 2021, compared to 111 funds in the previous quarter. Berkshire Hathaway Inc. (NYSE: BRK-A) delivered a -2.23% return in the past 3 months.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage.

Disclosure: None. This article is originally published at Insider Monkey.