ASML Holding N.V. (NASDAQ:ASML) is one of the top stocks to buy and hold forever. The company enjoys an unrivalled competitive position due to its monopoly on EUV lithography technology, which is critical for advanced semiconductors. This unique position has also helped ASML Holding N.V. (NASDAQ: ASML) to command one of the best operating margin profiles in the semiconductor equipment space, making it attractive to long-term investors.

Following its latest quarterly results on July 16, Wells Fargo analyst Joseph Quatrochi reiterated a Buy rating on ASML Holding N.V. (NASDAQ:ASML) with an unchanged price target of $890. His view was supported by strong order momentum, particularly in non-EUV systems, and encouraging demand from China. For the rest of 2025, the company is expecting substantial revenue from China.

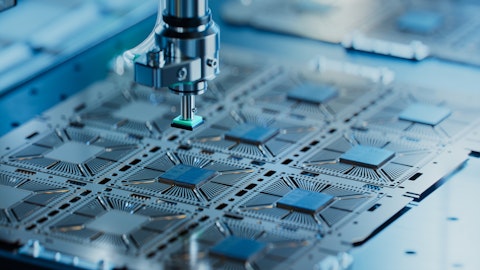

Photo by L N on Unsplash

ASML Holding N.V. (NASDAQ:ASML) had also raised its 2025 revenue outlook to roughly 15% year-over-year growth, broadly in line with consensus. However, the management refused to confirm revenue growth for 2026, citing macroeconomic uncertainty. This was against its earlier guidance of 2026 being a growth year, and market expectations of around 7% growth, which led to shares tanking around 8% on the results day.

Since Quatrochi’s update, the shares have largely moved sideways and now trade close to $754, the same level they settled at following that results day drop.

Despite the cautious guide, Quatrochi believed that while macro and geopolitical issues remain a risk for 2026, the company’s backlog and improving margins provided a buffer.

Later, on August 8 and 24, Goldman Sachs analyst Alexander Duval and Ruben Devos from Kepler Capital also reiterated their Buy ratings on ASML Holding N.V. (NASDAQ:ASML), reinforcing confidence in the company’s growth trajectory.

ASML Holding N.V. (NASDAQ:ASML) is a Netherlands-based technology company that designs and manufactures advanced lithography systems. ASML is the world’s largest supplier of lithography equipment and remains the sole provider of extreme ultraviolet (EUV) lithography machines, which are essential for producing leading-edge semiconductors at advanced process nodes (5nm and below).

While we acknowledge the potential of ASML to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than ASML and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 15 Best Data Center Stocks to Buy Now and 11 Deep Value Stocks to Buy According to Analysts.

Disclosure: None. This article is originally published at Insider Monkey.