Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze ARMOUR Residential REIT, Inc. (NYSE:ARR) from the perspective of those successful funds.

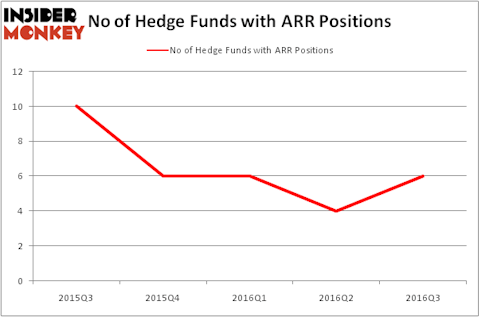

ARMOUR Residential REIT, Inc. (NYSE:ARR) has experienced an increase in hedge fund sentiment of late. ARR was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. There were 4 hedge funds in our database with ARR positions at the end of the previous quarter. At the end of this article we will also compare ARR to other stocks including Dominion Diamond Corp (NYSE:DDC), Babcock & Wilcox Enterprises Inc (NYSE:BW), and Five9 Inc (NASDAQ:FIVN) to get a better sense of its popularity.

Follow Armour Residential Reit Inc. (NYSE:ARR)

Follow Armour Residential Reit Inc. (NYSE:ARR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Fer Gregory/Shutterstock.com

With all of this in mind, let’s review the key action encompassing ARMOUR Residential REIT, Inc. (NYSE:ARR).

How have hedgies been trading ARMOUR Residential REIT, Inc. (NYSE:ARR)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from one quarter earlier. By comparison, 6 hedge funds held shares or bullish call options in ARR heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Andy Redleaf’s Whitebox Advisors has the number one position in ARMOUR Residential REIT, Inc. (NYSE:ARR), worth close to $18.5 million, amounting to 0.8% of its total 13F portfolio. The second most bullish fund manager is PEAK6 Capital Management, led by Matthew Hulsizer, which holds a $1.3 million call position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish contain Brian Taylor’s Pine River Capital Management, Mike Vranos’s Ellington and Ken Griffin’s Citadel Investment Group. We should note that Whitebox Advisors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.