Last quarter, Apple Inc. (NASDAQ:AAPL)‘s cash holdings topped $137 billion. Activists argue that the company’s hoarding policy reduces investor returns and management should pay out excess reserves. But does a big cash balance really hurt shareholders?

Cash earns a low rate of return

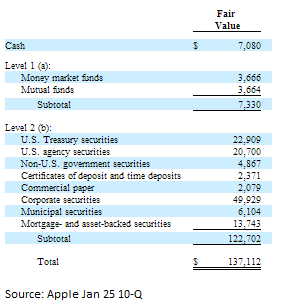

True, most of Apple’s reserves are invested in assets yielding less than 1%. according to Apple Inc. (NASDAQ:AAPL)’s most recent earnings report, its cash is invested in mostly Treasury bills, certificates of deposit, and commercial paper.

But investors must remember that these assets are risk free. If Apple Inc. (NASDAQ:AAPL) were to pay out its cash, investors could earn higher returns but only with higher risk.

So in terms of risk adjusted returns, Apple’s cash balance is neither good nor bad but neutral.

Photo credit: Apple Inc. (NASDAQ:AAPL)

The market is discounting Apple’s cash

Another problem is that the market may be discounting the cash sitting on Apple’s balance sheet beyond the obvious tax implications.

One reason why the market might do this is if Apple Inc. (NASDAQ:AAPL) is earning a return on its cash below the risk-free rate. But this doesn’t appear likely as most of Apple’s reserves are invested in exchange traded securities.

Another reason to discount Apple’s cash is fear it will by squandered on overpriced takeovers. Indeed, there’re are some justification for this. Hewlett-Packard Company (NYSE:HPQ), just one of too many sad examples, destroyed billions of dollars in shareholder wealth on acquisitions when they were sitting on excess cash. Shareholders would’ve been better served if management had opted for dividends.

Pundits have no shortage of acquisition ideas for Apple Inc. (NASDAQ:AAPL) either. For example, Jim Cramer recently recommended the company buy Netflix, Inc. (NASDAQ:NFLX) which he believes is attractive for three reasons: 1) Netflix would only cost between $15-$20 billion to acquire, a fraction of Apple’s annual free cash flow 2) Netflix would serve as a valuable distribution platform for Apple’s rumored iTV and 3) Netflix has a partnership deal with Facebook Inc (NASDAQ:FB). An acquisition would fill a hole in Apple’s social business.

But Apple isn’t likely to go down this route. The company’s acquisition strategy has been to buy small firms with great talent and valuable intellectual properties. Nothing like the flashy, bold targets Wall Street commentators like to plug. So I doubt the market is discounting Apple Inc. (NASDAQ:AAPL)’s cash for this reason either.

Low leverage discount

Because Apple has maintained such a large cash pile, it has missed out on the tax benefits of issuing debt.

Other technology companies have been experimenting with leverage. Last November, Microsoft Corporation (NASDAQ:MSFT) sold $2.2 billion in long-term debt to fund its dividend and share buyback program. Notably, the company issued 30 year bonds with a yield of less than 3.5% per year. By taking advantage of the low interest rate environment, Microsoft can reduce its cost of capital and unlock shareholder value.

A $50 billion debt issue could provide a quick price pop for Apple Inc. (NASDAQ:AAPL) shares. But my argument against this has always been to maintain financial flexibility. For the sake of a quick buck, a debt issue could bind the company if it finds itself on the wrong side of the next industry shift.

Should Apple even return the cash?

Here’s the crux of this debate: Would you rather own $450 dollars of Apple stock or $350 of Apple Inc. (NASDAQ:AAPL) stock plus $100 cash?

In most cases I would lead the charge for higher dividends or buybacks. Most management teams can’t resist the temptation to squander capital on wasteful side projects and empire building acquisitions.

But is that the case with Apple?

No, Apple has proven itself to be a good steward of shareholder capital. Of course, even Tim Cook has admitted he can’t find a productive use for $150 billion. But at the very least, if Apple holds on to its cash there’s always the possibility of a tax holiday.

Robert Baillieul has no position in any stocks mentioned. The Motley Fool recommends Apple and Netflix. The Motley Fool owns shares of Apple, Microsoft, and Netflix.