We at Insider Monkey have gone over 887 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of ANSYS, Inc. (NASDAQ:ANSS) based on that data.

Is ANSS stock a buy or sell? ANSYS, Inc. (NASDAQ:ANSS) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 40 hedge funds’ portfolios at the end of the fourth quarter of 2020. Our calculations also showed that ANSS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as AFLAC Incorporated (NYSE:AFL), Credit Suisse Group AG (NYSE:CS), and Kinder Morgan Inc (NYSE:KMI) to gather more data points.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to take a look at the recent hedge fund action regarding ANSYS, Inc. (NASDAQ:ANSS).

Do Hedge Funds Think ANSS Is A Good Stock To Buy Now?

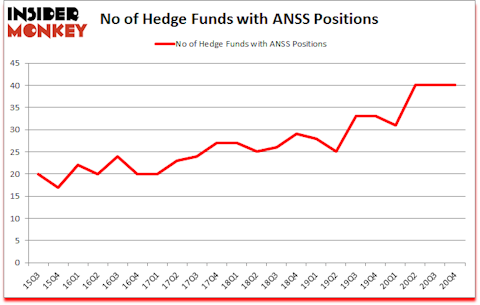

At the end of the fourth quarter, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the third quarter of 2020. Below, you can check out the change in hedge fund sentiment towards ANSS over the last 22 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in ANSYS, Inc. (NASDAQ:ANSS) was held by Akre Capital Management, which reported holding $221.8 million worth of stock at the end of December. It was followed by Impax Asset Management with a $174.6 million position. Other investors bullish on the company included Alkeon Capital Management, Ako Capital, and Intermede Investment Partners. In terms of the portfolio weights assigned to each position Crestwood Capital Management allocated the biggest weight to ANSYS, Inc. (NASDAQ:ANSS), around 8.53% of its 13F portfolio. Columbus Point is also relatively very bullish on the stock, setting aside 6.83 percent of its 13F equity portfolio to ANSS.

Seeing as ANSYS, Inc. (NASDAQ:ANSS) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of hedgies that slashed their full holdings by the end of the fourth quarter. At the top of the heap, Brandon Haley’s Holocene Advisors dropped the largest stake of the “upper crust” of funds followed by Insider Monkey, comprising close to $72.7 million in stock, and Anna Nikolayevsky’s Axel Capital Management was right behind this move, as the fund sold off about $13.1 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as ANSYS, Inc. (NASDAQ:ANSS) but similarly valued. These stocks are AFLAC Incorporated (NYSE:AFL), Credit Suisse Group AG (NYSE:CS), Kinder Morgan Inc (NYSE:KMI), Prudential Financial Inc (NYSE:PRU), Hilton Worldwide Holdings Inc (NYSE:HLT), ResMed Inc. (NYSE:RMD), and Republic Services, Inc. (NYSE:RSG). This group of stocks’ market caps are similar to ANSS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFL | 35 | 389034 | 1 |

| CS | 11 | 46020 | -2 |

| KMI | 42 | 1031459 | -4 |

| PRU | 36 | 532348 | 2 |

| HLT | 60 | 6029309 | 3 |

| RMD | 27 | 355462 | -8 |

| RSG | 36 | 1099427 | -1 |

| Average | 35.3 | 1354723 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.3 hedge funds with bullish positions and the average amount invested in these stocks was $1355 million. That figure was $1633 million in ANSS’s case. Hilton Worldwide Holdings Inc (NYSE:HLT) is the most popular stock in this table. On the other hand Credit Suisse Group AG (NYSE:CS) is the least popular one with only 11 bullish hedge fund positions. ANSYS, Inc. (NASDAQ:ANSS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ANSS is 64.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and beat the market again by 0.8 percentage points. Unfortunately ANSS wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on ANSS were disappointed as the stock returned -10.9% since the end of December (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Ansys Inc (NASDAQ:ANSS)

Follow Ansys Inc (NASDAQ:ANSS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.