We at Insider Monkey have gone over 873 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article, we look at what those funds think of Amkor Technology, Inc. (NASDAQ:AMKR) based on that data.

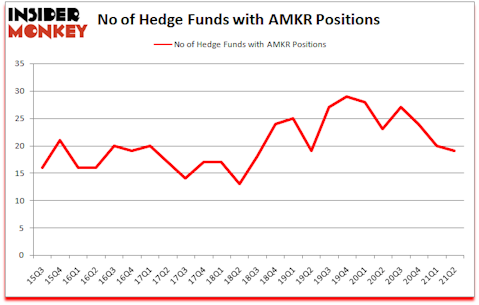

Amkor Technology, Inc. (NASDAQ:AMKR) has experienced a decrease in activity from the world’s largest hedge funds of late. Amkor Technology, Inc. (NASDAQ:AMKR) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 29. There were 20 hedge funds in our database with AMKR holdings at the end of March. Our calculations also showed that AMKR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Lee Ainslie of Maverick Capital

Now let’s view the recent hedge fund action encompassing Amkor Technology, Inc. (NASDAQ:AMKR).

Do Hedge Funds Think AMKR Is A Good Stock To Buy Now?

At second quarter’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AMKR over the last 24 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, SW Investment Management was the largest shareholder of Amkor Technology, Inc. (NASDAQ:AMKR), with a stake worth $47.3 million reported as of the end of June. Trailing SW Investment Management was Royce & Associates, which amassed a stake valued at $27.6 million. Arrowstreet Capital, Bandera Partners, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position SW Investment Management allocated the biggest weight to Amkor Technology, Inc. (NASDAQ:AMKR), around 18.11% of its 13F portfolio. Bandera Partners is also relatively very bullish on the stock, setting aside 7.59 percent of its 13F equity portfolio to AMKR.

Since Amkor Technology, Inc. (NASDAQ:AMKR) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few funds who were dropping their entire stakes heading into Q3. Interestingly, Dan Rasmussen’s Verdad Advisers said goodbye to the largest investment of all the hedgies monitored by Insider Monkey, worth close to $7.7 million in stock. Suraj Parkash Chopra’s fund, Force Hill Capital Management, also cut its stock, about $4.3 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Amkor Technology, Inc. (NASDAQ:AMKR) but similarly valued. These stocks are Q2 Holdings Inc (NYSE:QTWO), Alteryx, Inc. (NYSE:AYX), Integra Lifesciences Holdings Corp (NASDAQ:IART), Nevro Corp (NYSE:NVRO), Evercore Inc. (NYSE:EVR), The Chemours Company (NYSE:CC), and Elbit Systems Ltd. (NASDAQ:ESLT). This group of stocks’ market valuations are closest to AMKR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QTWO | 19 | 208105 | -7 |

| AYX | 33 | 782027 | -2 |

| IART | 19 | 94167 | 6 |

| NVRO | 26 | 716353 | -3 |

| EVR | 31 | 342871 | 0 |

| CC | 24 | 562111 | -3 |

| ESLT | 4 | 48909 | 1 |

| Average | 22.3 | 393506 | -1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.3 hedge funds with bullish positions and the average amount invested in these stocks was $394 million. That figure was $155 million in AMKR’s case. Alteryx, Inc. (NYSE:AYX) is the most popular stock in this table. On the other hand Elbit Systems Ltd. (NASDAQ:ESLT) is the least popular one with only 4 bullish hedge fund positions. Amkor Technology, Inc. (NASDAQ:AMKR) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for AMKR is 49.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately AMKR wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); AMKR investors were disappointed as the stock returned -5.7% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Amkor Technology Inc. (NASDAQ:AMKR)

Follow Amkor Technology Inc. (NASDAQ:AMKR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Oil Refining Companies

- 15 Largest Vehicles In The World

- 10 Best Railroad Stocks to Buy in 2021

Disclosure: None. This article was originally published at Insider Monkey.