The SEC requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on September 30. We at Insider Monkey have compiled an extensive database of more than 700 of those successful funds and prominent investors’ filings. In this article, we analyze how these successful funds and prominent investors traded Ambev SA (ADR) (NYSE:ABEV) based on those filings.

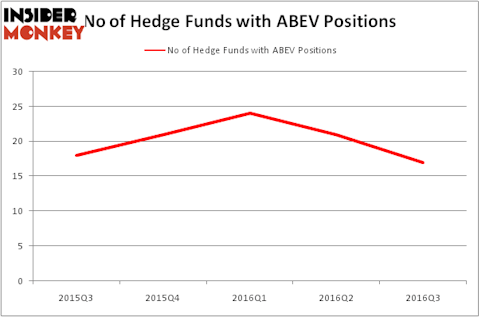

Ambev SA (ADR) (NYSE:ABEV)investors should pay attention to a decrease in hedge fund interest of late. There were 21 hedge funds in our database with ABEV holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as China Petroleum & Chemical Corp (ADR) (NYSE:SNP), Eli Lilly & Co. (NYSE:LLY), and United Technologies Corporation (NYSE:UTX) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, we’re going to take a look at the latest action surrounding Ambev SA (ADR) (NYSE:ABEV).

Hedge fund activity in Ambev SA (ADR) (NYSE:ABEV)

Heading into the fourth quarter of 2016, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 19% from the previous quarter. On the other hand, there were a total of 21 hedge funds with a bullish position in ABEV at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Fisher Asset Management, led by Ken Fisher, holds the most valuable position in Ambev SA (ADR) (NYSE:ABEV). Fisher Asset Management has a $145.1 million position in the stock, comprising 0.3% of its 13F portfolio. On Fisher Asset Management’s heels is AQR Capital Management, led by Cliff Asness, holding a $75.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions include William von Mueffling’s Cantillon Capital Management, John Horseman’s Horseman Capital Management and Jim Simons’s Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually dumped their positions entirely. At the top of the heap, Richard Driehaus’s Driehaus Capital dumped the biggest stake of the “upper crust” of funds studied by Insider Monkey, worth about $19.4 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund dropped about $3.1 million worth of shares.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Ambev SA (ADR) (NYSE:ABEV) but similarly valued. We will take a look at China Petroleum & Chemical Corp (ADR) (NYSE:SNP), Eli Lilly & Co. (NYSE:LLY), United Technologies Corporation (NYSE:UTX), and Starbucks Corporation (NASDAQ:SBUX). This group of stocks’ market caps are closest to ABEV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNP | 11 | 41406 | 2 |

| LLY | 55 | 2889477 | 6 |

| UTX | 48 | 3552166 | -8 |

| SBUX | 46 | 1136868 | -7 |

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $1.91 billion. That figure was just $423 million in ABEV’s case. Eli Lilly & Co. (NYSE:LLY) is the most popular stock in this table. On the other hand China Petroleum & Chemical Corp (ADR) (NYSE:SNP) is the least popular one with only 11 bullish hedge fund positions. Ambev SA (ADR) (NYSE:ABEV) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LLY might be a better candidate to consider taking a long position in.

Suggested Articles:

Top Selling Cigarettes In The World

Best Places To Get Married In Las Vegas

Best Selling Consumer Products In The USA

Disclosure: None