We recently published a list of 10 Tech Stocks That Trump’s Fellow Republican Bought Amid Market Rout. In this article, we are going to take a look at where Amazon.com, Inc. (NASDAQ:AMZN) stands against other tech stocks that Trump’s fellow Republican bought amid market rout.

Keeping track of politicians’ stock investments is a good way of determining which stocks may receive favorable policy treatment from the government down the road. By looking at the committees these politicians sit in, and the policy matters they are dealing with, investors can gain insights into what’s to follow for certain industries.

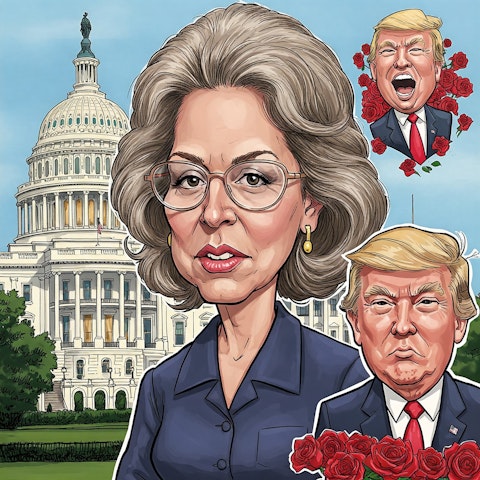

The STOCK Act requires these politicians to report their trades within 45 days of placing them. These disclosures are then made public, making the process as transparent as possible. While looking at some recent disclosures, we noticed certain politicians who stood out. One such politician was Trump’s fellow Republican Marjorie Taylor Greene, who bought stocks on the 3rd and 4th of April, two days when the S&P lost over 10% of its value!

Some of these stocks have already recovered from their lows hit that day, showing how Ms Greene was able to buy stocks that recovered swiftly despite the broader market continuing to struggle.

To come up with our list of 10 tech stocks that Trump’s fellow Republican bought amid the market rout, we looked at the Republican’s two recent filings on the 7th and 11th of April, where she reported these trades. We then ranked them by the number of hedge funds that hold the company’s stock in their portfolio.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

Amazon.com, Inc. (NASDAQ:AMZN)

Number of Hedge Fund Holders: 339

Amazon.com engages in multiple businesses, including advertising, subscription services, cloud services, and its most popular Amazon.com ecommerce platform. The company announces its quarterly earnings next week, and the stock is struggling leading up to the important day.

Wells Fargo reported yesterday that the company had paused leases on some data centers. The news is similar to what Microsoft reported earlier in the year. For context, this does not affect already signed leases, it is just a case of the company slowing down and delaying the execution of future leases.

Whether this development is concerning or not remains to be seen. The company itself is calling it routine capacity management. Meanwhile, analysts are also on the edge, with Raymond James downgrading the stock and cutting the price target from $275 to $195, citing China exposure as the main reason.

Morgan Stanley is also cautious, clearly saying that it may take some time before the investment bank can get some clarity on how the tariff threat is likely to play out. The bank has a price target of $245 on the stock.

Overall, AMZN ranks 1st on our list of tech stocks that Trump’s fellow Republican bought amid market rout. While we acknowledge the potential of AMZN as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. There is an AI stock that went up since the beginning of 2025, while popular AI stocks lost around 25%. If you are looking for an AI stock that is more promising than AMZN but that trades at less than 5 times its earnings, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. This article is originally published at Insider Monkey.