You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

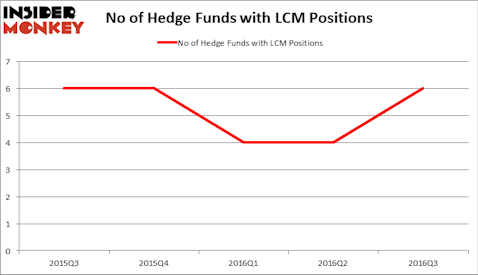

Is Advent/Claymore Enhanced Growth & Income (NYSE:LCM) a buy right now? Prominent investors are definitely in an optimistic mood. The number of bullish hedge fund bets swelled by 2 recently. There were 6 hedge funds in our database with LCM holdings at the end of the third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Northwest Pipe Company (NASDAQ:NWPX), U.S. Auto Parts Network, Inc. (NASDAQ:PRTS), and Jernigan Capital Inc (NYSE:JCAP) to gather more data points.

Follow Adventaymore Enhanced Growth & Income Fund (NYSE:LCM)

Follow Adventaymore Enhanced Growth & Income Fund (NYSE:LCM)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

ZIDO SUN/Shutterstock.com

With all of this in mind, we’re going to take a look at the new action regarding Advent/Claymore Enhanced Growth & Income (NYSE:LCM).

How are hedge funds trading Advent/Claymore Enhanced Growth & Income (NYSE:LCM)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a jump of 50% from one quarter earlier. By comparison, 6 hedge funds held shares or bullish call options in LCM heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Phillip Goldstein, Andrew Dakos and Steven Samuels’s Bulldog Investors has the biggest position in Advent/Claymore Enhanced Growth & Income (NYSE:LCM), worth close to $12.2 million, accounting for 2.8% of its total 13F portfolio. The second most bullish fund manager is Saba Capital, led by Boaz Weinstein, holding an $8.6 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions encompass William Michaelcheck’s Mariner Investment Group, Andrew Weiss’s Weiss Asset Management and Bart Baum’s Ionic Capital Management. We should note that Saba Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Weiss Asset Management, led by Andrew Weiss, initiated the most valuable position in Advent/Claymore Enhanced Growth & Income (NYSE:LCM). According to its latest 13F filing, the fund had $1.3 million invested in the company at the end of the quarter. Charles Clough’s Clough Capital Partners also initiated a $0.8 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Advent/Claymore Enhanced Growth & Income (NYSE:LCM). These stocks are Northwest Pipe Company (NASDAQ:NWPX), U.S. Auto Parts Network, Inc. (NASDAQ:PRTS), Jernigan Capital Inc (NYSE:JCAP), and Civista Bancshares Inc (NASDAQ:CIVB). All of these stocks’ market caps match LCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NWPX | 5 | 17137 | -1 |

| PRTS | 5 | 15282 | -1 |

| JCAP | 5 | 9353 | 1 |

| CIVB | 4 | 14622 | 0 |

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $14 million. That figure was $26 million in LCM’s case. Northwest Pipe Company (NASDAQ:NWPX) is the most popular stock in this table. On the other hand Civista Bancshares Inc (NASDAQ:CIVB) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Advent/Claymore Enhanced Growth & Income (NYSE:LCM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.