Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

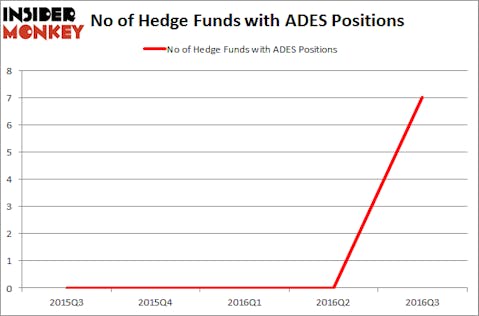

Is Advanced Emissions Solutions, Inc. (NASDAQ:ADES) an excellent investment today? The best stock pickers are undoubtedly getting more optimistic. The number of bullish hedge fund positions inched up by 7 lately. There were 7 hedge funds in our database with ADES holdings at the end of September. At the end of this article we will also compare ADES to other stocks including Westmoreland Coal Company (NASDAQ:WLB), KEMET Corporation (NYSE:KEM), and Dawson Geophysical Company (NASDAQ:DWSN) to get a better sense of its popularity.

Follow Arq Inc. (NASDAQ:ARQ)

Follow Arq Inc. (NASDAQ:ARQ)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Dmitry Kalinovsky/Shutterstock.com

Now, we’re going to take a look at the key action surrounding Advanced Emissions Solutions, Inc. (NASDAQ:ADES).

How are hedge funds trading Advanced Emissions Solutions, Inc. (NASDAQ:ADES)?

Heading into the fourth quarter of 2016, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock. By comparison, 0 hedge funds held shares or bullish call options in ADES heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Coliseum Capital, led by Christopher Shackelton and Adam Gray, holds the number one position in Advanced Emissions Solutions, Inc. (NASDAQ:ADES). Coliseum Capital has a $15.8 million position in the stock, comprising 5.5% of its 13F portfolio. Sitting at the No. 2 spot is Jonathan Savitz of Greywolf Capital Management, with a $15.6 million position; the fund has 3.3% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism consist of Jeremy Carton and Gilbert Li’s Alta Fundamental Advisers, Michael Price’s MFP Investors and Jon Bauer’s Contrarian Capital. We should note that MFP Investors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.