Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Accelerate Diagnostics Inc (NASDAQ:AXDX) from the perspective of those successful funds.

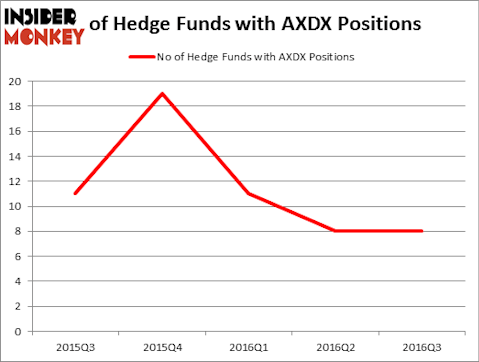

Hedge fund interest in Accelerate Diagnostics Inc (NASDAQ:AXDX) shares was flat at the end of last quarter, with 8 hedge funds bullish on the stock. This is usually a negative indicator. At the end of this article we will also compare AXDX to other stocks including MSG Networks Inc (NYSE:MSGN), Hub Group Inc (NASDAQ:HUBG), and Moelis & Co (NYSE:MC) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Natee K Jindakum/Shutterstock.com

How have hedgies been trading Accelerate Diagnostics Inc (NASDAQ:AXDX)?

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a unchanged from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards AXDX over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Matthew Strobeck’s Birchview Capital has the largest position in Accelerate Diagnostics Inc (NASDAQ:AXDX), worth close to $59.3 million, corresponding to 34.6% of its total 13F portfolio. Sitting at the No. 2 spot is Noah Levy and Eugene Dozortsev of Newtyn Management, with a $16.4 million position; 3.8% of its 13F portfolio is allocated to the company. Other peers that are bullish include Pasco Alfaro / Richard Tumure’s Miura Global Management, Stewart Strawbridge’s Selkirk Management and Stuart Weisbrod’s Iguana Healthcare Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Accelerate Diagnostics Inc (NASDAQ:AXDX) has gone through a decline in interest from the smart money, logic holds that there were a few hedgies that decided to sell off their entire stakes heading into Q4. Intriguingly, Anand Parekh’s Alyeska Investment Group sold off the biggest position of all the hedgies tracked by Insider Monkey, valued at an estimated $2.3 million in stock. Israel Englander’s fund, Millennium Management, one of the 10 largest hedge funds in the world, also dumped its stock, about $0.4 million worth.

Let’s check out hedge fund activity in other stocks similar to Accelerate Diagnostics Inc (NASDAQ:AXDX). We will take a look at MSG Networks Inc (NYSE:MSGN), Hub Group Inc (NASDAQ:HUBG), Moelis & Co (NYSE:MC), and Synergy Resources Corp (NYSEAMEX:SYRG). This group of stocks’ market valuations are closest to AXDX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSGN | 24 | 324337 | 3 |

| HUBG | 21 | 286593 | 4 |

| MC | 10 | 71733 | 2 |

| SYRG | 12 | 270087 | -6 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $238 million. That figure was $100 million in AXDX’s case. MSG Networks Inc (NYSE:MSGN) is the most popular stock in this table. On the other hand Moelis & Co (NYSE:MC) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Accelerate Diagnostics Inc (NASDAQ:AXDX) is even less popular than MC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None