There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Abaxis Inc (NASDAQ:ABAX).

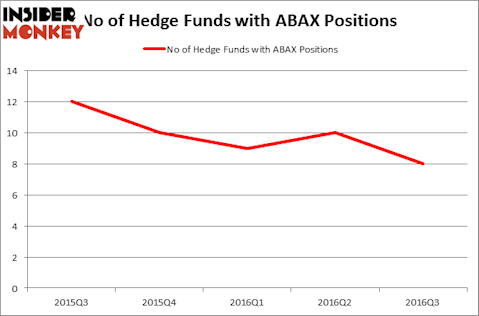

Abaxis Inc (NASDAQ:ABAX) was in 8 hedge funds’ portfolios at the end of the third quarter of 2016. ABAX has experienced a decrease in activity from the world’s largest hedge funds of late. There were 10 hedge funds in our database with ABAX positions at the end of the previous quarter. At the end of this article we will also compare ABAX to other stocks including Coherus Biosciences Inc (NASDAQ:CHRS), Brookfield Business Partners L.P. Limited Partnership Units(NYSE:BBU), and Engility Holdings Inc (NYSE:EGL) to get a better sense of its popularity.

Follow Abaxis Inc (NASDAQ:ABAX)

Follow Abaxis Inc (NASDAQ:ABAX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Natee K Jindakum/Shutterstock.com

How have hedgies been trading Abaxis Inc (NASDAQ:ABAX)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ABAX over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Echo Street Capital Management, led by Greg Poole, holds the biggest position in Abaxis Inc (NASDAQ:ABAX). Echo Street Capital Management has a $11.3 million position in the stock. Sitting at the No. 2 spot is Renaissance Technologies, one of the largest hedge funds in the world, which holds a $8.8 million position. Other members of the smart money that are bullish consist of Joel Greenblatt’s Gotham Asset Management, Peter Muller’s PDT Partners and Mark Coe’s Coe Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.