Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about AAR Corp. (NYSE:AIR) in this article.

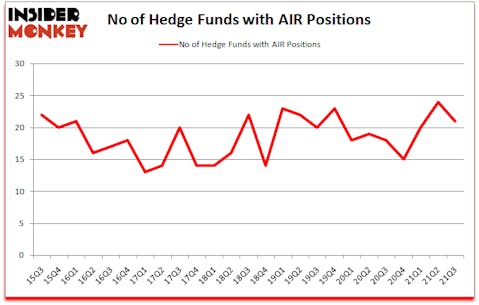

Is AIR a good stock to buy now? AAR Corp. (NYSE:AIR) was in 21 hedge funds’ portfolios at the end of September. The all time high for this statistic is 24. AIR has seen a decrease in support from the world’s most elite money managers lately. There were 24 hedge funds in our database with AIR holdings at the end of June. Our calculations also showed that AIR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to take a glance at the recent hedge fund action surrounding AAR Corp. (NYSE:AIR).

Ken Fisher of Fisher Asset Management

Do Hedge Funds Think AIR Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2021, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AIR over the last 25 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in AAR Corp. (NYSE:AIR) was held by Rubric Capital Management, which reported holding $50.3 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $20 million position. Other investors bullish on the company included Royce & Associates, Millennium Management, and Clearline Capital. In terms of the portfolio weights assigned to each position Diametric Capital allocated the biggest weight to AAR Corp. (NYSE:AIR), around 1.99% of its 13F portfolio. Rubric Capital Management is also relatively very bullish on the stock, designating 1.41 percent of its 13F equity portfolio to AIR.

Seeing as AAR Corp. (NYSE:AIR) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of fund managers that slashed their entire stakes last quarter. It’s worth mentioning that Paul Tudor Jones’s Tudor Investment Corp said goodbye to the largest stake of the 750 funds followed by Insider Monkey, comprising about $0.9 million in stock. Gavin Saitowitz and Cisco J. del Valle’s fund, Prelude Capital (previously Springbok Capital), also dumped its stock, about $0.4 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 3 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as AAR Corp. (NYSE:AIR) but similarly valued. These stocks are FREYR Battery (NYSE:FREY), Enanta Pharmaceuticals Inc (NASDAQ:ENTA), ImmunoGen, Inc. (NASDAQ:IMGN), GH Research PLC (NASDAQ:GHRS), Boston Omaha Corporation (NASDAQ:BOMN), Fortuna Silver Mines Inc. (NYSE:FSM), and Tivity Health, Inc. (NASDAQ:TVTY). All of these stocks’ market caps are similar to AIR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FREY | 20 | 378008 | 20 |

| ENTA | 13 | 283768 | -1 |

| IMGN | 26 | 362563 | 0 |

| GHRS | 16 | 407704 | 16 |

| BOMN | 2 | 275242 | -1 |

| FSM | 10 | 17241 | -4 |

| TVTY | 17 | 369312 | -5 |

| Average | 14.9 | 299120 | 3.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.9 hedge funds with bullish positions and the average amount invested in these stocks was $299 million. That figure was $198 million in AIR’s case. ImmunoGen, Inc. (NASDAQ:IMGN) is the most popular stock in this table. On the other hand Boston Omaha Corporation (NASDAQ:BOMN) is the least popular one with only 2 bullish hedge fund positions. AAR Corp. (NYSE:AIR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AIR is 67.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on AIR as the stock returned 20.4% since the end of Q3 (through 12/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Aar Corp (NYSE:AIR)

Follow Aar Corp (NYSE:AIR)

Receive real-time insider trading and news alerts

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.