We came across a bullish thesis on Intuitive Machines, Inc. on Value investing subreddit by andthentherewastwo. In this article, we will summarize the bulls’ thesis on LUNR. Intuitive Machines, Inc.’s share was trading at $9.50 as of November 28th. LUNR shares underperformed the market by more than 30 percentage points over the last 12 months.

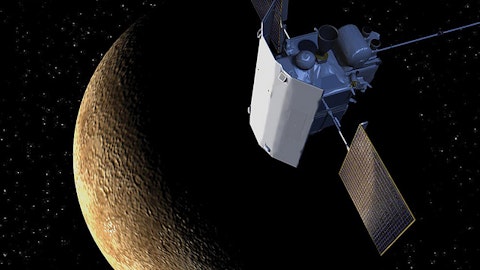

Intuitive Machines, Inc. designs, manufactures, and operates space products and services in the United States. LUNR is positioned as a high-potential, binary space play, known for its dramatic pre-launch stock run-ups. Currently trading around $12, the stock is heavily discounted despite a strong cash position of approximately $345 million against a $2 billion market cap, making its enterprise value particularly attractive for a U.S. space prime contractor.

LUNR’s stock follows a highly predictable cycle: announcement of a launch date triggers a sharp rally, followed by a mission, post-mission crash, and eventual recovery—placing the stock at a low point heading into the next announcement phase.

Two near-term catalysts are set to drive the next major price movement within the next six months. The first is the Q3 2025 earnings call on November 13th, which is expected to confirm the launch window for the IM-3 mission, currently targeted for H1 2026, historically a signal that ignites significant stock appreciation. The second catalyst is the potential NASA Lunar Terrain Vehicle (LTV) contract award, expected before year-end 2025, which could add a multi-billion-dollar backlog and substantially de-risk LUNR’s long-term revenue outlook.

The upcoming IM-3 mission targets Reiner Gamma, a technically easier lunar swirl landing site, with improved safeguards such as redundant altimeters addressing previous IM-2 mission issues. Success on this mission could validate LUNR’s core business model and potentially lift the stock to a sustained higher valuation. Given the predictable pre-launch hype cycle, strong cash buffer, and the potential for a transformative NASA contract, LUNR presents a compelling risk/reward setup, offering investors a strategic entry point ahead of multiple binary catalysts that could drive both short-term and long-term upside.

Previously we covered a bullish thesis on Rocket Lab USA, Inc. (RKLB) by Steve Wagner in May 2025, which highlighted the company’s strong operational momentum, growing backlog, and leadership in small orbital launches. The company’s stock price has appreciated approximately by 105.46% since our coverage as the thesis played out. The thesis still stands, while Andthentherewastwo shares a similar perspective but emphasizes LUNR’s pre-launch hype cycle and near-term catalysts like the IM-3 mission and potential NASA LTV contract.

Intuitive Machines, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 27 hedge fund portfolios held LUNR at the end of the second quarter which was 21 in the previous quarter. While we acknowledge the risk and potential of LUNR as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than LUNR and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy NOW

Disclosure: None.