Is The Ultimate Software Group, Inc. (NASDAQ:ULTI) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They fail miserably sometimes but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

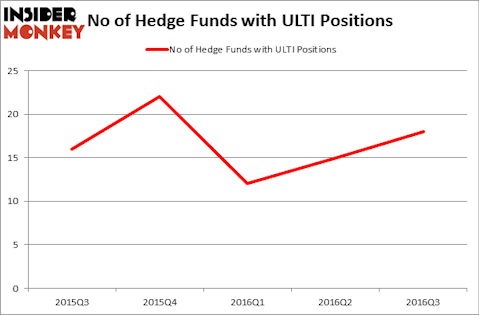

Is The Ultimate Software Group, Inc. (NASDAQ:ULTI) undervalued? The best stock pickers are becoming more confident. The number of long hedge fund investments grew by 3 recently. ULTI was in 18 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with ULTI holdings at the end of the previous quarter. At the end of this article we will also compare ULTI to other stocks including Apollo Global Management LLC (NYSE:APO), FMC Technologies, Inc. (NYSE:FTI), and Tyler Technologies, Inc. (NYSE:TYL) to get a better sense of its popularity.

Follow Ultimate Software Group Inc (NASDAQ:ULTI)

Follow Ultimate Software Group Inc (NASDAQ:ULTI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

YURALAITS ALBERT/Shutterstock.com

How are hedge funds trading The Ultimate Software Group, Inc. (NASDAQ:ULTI)?

At the end of the third quarter, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 20% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in ULTI at the beginning of this year. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the biggest position in The Ultimate Software Group, Inc. (NASDAQ:ULTI), worth close to $74.7 million. On Citadel Investment Group’s heels is Matthew A. Weatherbie of Weatherbie Capital, with a $25.3 million position; 3.2% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors with similar optimism comprise Greg Poole’s Echo Street Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Dennis Leibowitz’s Act II Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.