We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Terrapin 3 Acquisition Corp (NASDAQ:TRTL), and what that likely means for the prospects of the company and its stock.

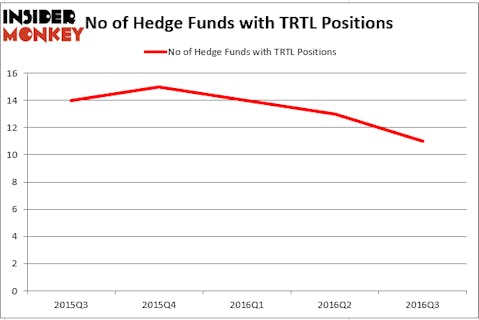

Is Terrapin 3 Acquisition Corp (NASDAQ:TRTL) a buy at the moment? Prominent investors are surely in a pessimistic mood. The number of long hedge fund bets retreated by 2 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Harmony Merger Corp (NASDAQ:HRMN), Stage Stores Inc (NYSE:SSI), and Salem Communications Corp (NASDAQ:SALM) to gather more data points.

Follow Terrapin 3 Acquisition Corp (NYSE:TRTL)

Follow Terrapin 3 Acquisition Corp (NYSE:TRTL)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Andrey_Popov/shutterstock.com

Hedge fund activity in Terrapin 3 Acquisition Corp (NASDAQ:TRTL)

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 15% drop from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in TRTL at the beginning of this year, which shows an even steeper drop in 2016. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Fir Tree, founded by Jeffrey Tannenbaum, holds the largest position in Terrapin 3 Acquisition Corp (NASDAQ:TRTL). Fir Tree has an $18.2 million position in the stock. The second largest stake is held by Highbridge Capital Management, led by Glenn Russell Dubin, which has a $7.5 million position. Remaining peers that hold long positions encompass Louis Bacon’s Moore Global Investments, Nick Niell’s Arrowgrass Capital Partners, and Andrew Weiss’ Weiss Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at a fund that dropped its entire stakes in the stock during the third quarter. Sander Gerber’s Hudson Bay Capital Management dropped the biggest position of all the hedgies followed by Insider Monkey, worth about $14.9 million in stock.

Let’s now review hedge fund activity in other stocks similar to Terrapin 3 Acquisition Corp (NASDAQ:TRTL). We will take a look at Harmony Merger Corp (NASDAQ:HRMN), Stage Stores Inc (NYSE:SSI), Salem Communications Corp (NASDAQ:SALM), and Silvercrest Asset Management Group Inc (NASDAQ:SAMG). This group of stocks’ market valuations are closest to TRTL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HRMN | 7 | 31686 | 1 |

| SSI | 5 | 2413 | 2 |

| SALM | 6 | 8875 | 0 |

| SAMG | 3 | 10061 | -1 |

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $13 million. That figure was $41 million in TRTL’s case. Harmony Merger Corp (NASDAQ:HRMN) is the most popular stock in this table. On the other hand Silvercrest Asset Management Group Inc (NASDAQ:SAMG) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Terrapin 3 Acquisition Corp (NASDAQ:TRTL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None