Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

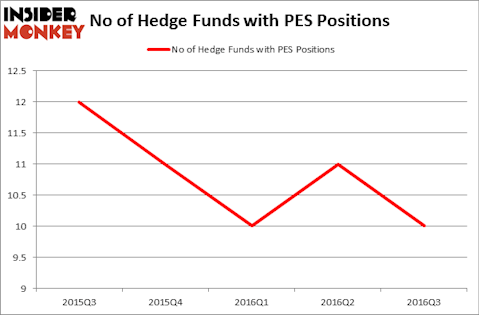

Is Pioneer Energy Services Corp (NYSE:PES) a healthy stock for your portfolio? Investors who are in the know are actually taking a pessimistic view. The number of bullish hedge fund bets that are revealed through 13F filings shrunk by 1 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Ignyta Inc (NASDAQ:RXDX), Safeguard Scientifics, Inc (NYSE:SFE), and Kandi Technolgies Corp. (NASDAQ:KNDI) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

QiuJu Song/Shuterrstock.com

Hedge fund activity in Pioneer Energy Services Corp (NYSE:PES)

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 9% dip from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PES over the last 5 quarters, which has trended down within a narrow range. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’ AQR Capital Management has the most valuable position in Pioneer Energy Services Corp (NYSE:PES), worth close to $0.7 million. Coming in second is Glenn Russell Dubin of Highbridge Capital Management, also with a $0.7 million position. Some other hedge funds and institutional investors with similar optimism contain Michael Platt and William Reeves’ BlueCrest Capital Mgmt, Peter Muller’s PDT Partners, and D E Shaw, one of the biggest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Pioneer Energy Services Corp (NYSE:PES) has faced bearish sentiment from the smart money, it’s easy to see that there lies a certain “tier” of hedgies that elected to cut their entire stakes in the third quarter. At the top of the heap, Paul Tudor Jones’ Tudor Investment Corp got rid of the largest investment of all the hedgies watched by Insider Monkey, valued at about $0.1 million in stock, and Mike Vranos’ Ellington was right behind this move, as the fund cut about $0.1 million worth of shares also.

Let’s go over hedge fund activity in other stocks similar to Pioneer Energy Services Corp (NYSE:PES). We will take a look at Ignyta Inc (NASDAQ:RXDX), Safeguard Scientifics, Inc (NYSE:SFE), Kandi Technolgies Corp. (NASDAQ:KNDI), and Selecta Biosciences Inc (NASDAQ:SELB). All of these stocks’ market caps resemble PES’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RXDX | 16 | 94094 | 0 |

| SFE | 5 | 3546 | -1 |

| KNDI | 3 | 741 | 2 |

| SELB | 5 | 36428 | -2 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $34 million. That figure was just $4 million in PES’s case. Ignyta Inc (NASDAQ:RXDX) is the most popular stock in this table. On the other hand Kandi Technolgies Corp. (NASDAQ:KNDI) is the least popular one with only 3 bullish hedge fund positions. Pioneer Energy Services Corp (NYSE:PES) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on and pouring money into. In this regard RXDX might be a better candidate to consider taking a long position in.

Disclosure: None