Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

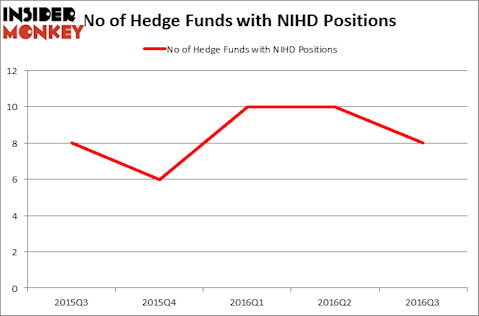

NII Holdings, Inc. (NASDAQ:NIHD) investors should be aware of a decrease in hedge fund interest in recent months. There were 10 hedge funds in our database with NIHD positions at the end of the second quarter, 2 more than there were at the end of September. At the end of this article we will also compare NIHD to other stocks including NV5 Holdings Inc (NASDAQ:NVEE), Sinovac Biotech Ltd. (NASDAQ:SVA), and CommunityOne Bancorp (NASDAQ:COB) to get a better sense of its popularity.

Follow Nii Holdings Inc (NASDAQ:NIHD)

Follow Nii Holdings Inc (NASDAQ:NIHD)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

hin255/Shutterstock.com

How are hedge funds trading NII Holdings, Inc. (NASDAQ:NIHD)?

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a fall of 20% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NIHD over the last 5 quarters, which has been somewhat volatile, though in a relatively narrow range. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Aurelius Capital Management, led by Mark Brodsky, holds the most valuable position in NII Holdings, Inc. (NASDAQ:NIHD). Aurelius Capital Management has a $26.5 million position in the stock, comprising 3.7% of its 13F portfolio. The second most bullish fund manager is Empyrean Capital Partners, led by Michael A. Price and Amos Meron, which holds a $13.4 million position. Remaining hedge funds and institutional investors that hold long positions encompass Andy Redleaf’s Whitebox Advisors, Curtis Schenker and Craig Effron’s Scoggin, and Cliff Asness’ AQR Capital Management. We should note that Whitebox Advisors is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that got rid of their entire stakes in the stock during the third quarter. It’s worth mentioning that Steven Tananbaum’s GoldenTree Asset Management got rid of the biggest stake of all the investors followed by Insider Monkey, totaling close to $4.5 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund dumped about $0.2 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks similar to NII Holdings, Inc. (NASDAQ:NIHD). These stocks are NV5 Holdings Inc (NASDAQ:NVEE), Sinovac Biotech Ltd. (NASDAQ:SVA), CommunityOne Bancorp (NASDAQ:COB), and Bill Barrett Corporation (NYSE:BBG). This group of stocks’ market valuations match NIHD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVEE | 7 | 24845 | -3 |

| SVA | 6 | 25685 | 2 |

| COB | 4 | 6520 | 0 |

| BBG | 19 | 87696 | 0 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $54 million in NIHD’s case. Bill Barrett Corporation (NYSE:BBG) is the most popular stock in this table. On the other hand CommunityOne Bancorp (NASDAQ:COB) is the least popular one with only 4 bullish hedge fund positions. NII Holdings, Inc. (NASDAQ:NIHD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BBG might be a better candidate to consider taking a long position in.

Disclosure: None