Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. The second half of 2015 and the first few months of this year was a stressful period for hedge funds. However, things have been taking a turn for the better in the second half of this year. Small-cap stocks which hedge funds are usually overweight outperformed the market by double digits and it may be a good time to pay attention to hedge funds’ picks before it is too late. In this article we are going to analyze the hedge fund sentiment towards Kellogg Company (NYSE:K) to find out whether it was one of their high conviction long-term ideas.

Kellogg Company (NYSE:K) shareholders have witnessed a huge increase in hedge fund sentiment in recent months. There were 27 hedge funds in our database with K holdings at the end of June. At the end of this article we will also compare Kellogg Company to other stocks including Deere & Company (NYSE:DE), Sempra Energy (NYSE:SRE), and Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS) to get a better sense of its popularity.

Follow Kellanova (NYSE:K)

Follow Kellanova (NYSE:K)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, let’s analyze the recent action surrounding Kellogg Company (NYSE:K).

How are hedge funds trading Kellogg Company (NYSE:K)?

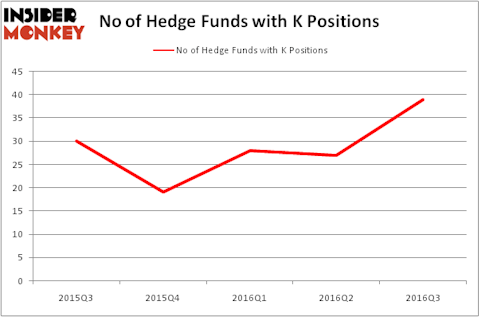

At Q3’s end, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a boost of 44% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards K over the last 5 quarters. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Rob Citrone’s Discovery Capital Management has the biggest position in Kellogg Company (NYSE:K), worth close to $254.8 million, comprising 5.4% of its total 13F portfolio. The second most bullish fund manager is Israel Englander’s Millennium Management, holding a $148.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other peers that are bullish encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Robert Pohly’s Samlyn Capital and Zach Schreiber’s Point State Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.