Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

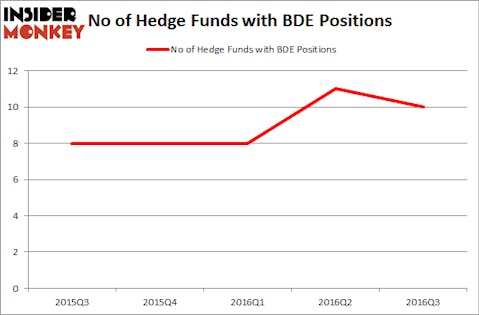

Black Diamond Inc (NASDAQ:BDE) shareholders have witnessed a decrease in support from the world’s most successful money managers lately. BDE was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. There were 11 hedge funds in our database with BDE holdings at the end of the previous quarter. At the end of this article we will also compare BDE to other stocks including Proteon Therapeutics Inc (NASDAQ:PRTO), Republic First Bancorp, Inc. (NASDAQ:FRBK), and Dynamic Materials Corporation (NASDAQ:BOOM) to get a better sense of its popularity.

Follow Clarus Corp (NASDAQ:CLAR)

Follow Clarus Corp (NASDAQ:CLAR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Xseon/Shutterstock.com

How are hedge funds trading Black Diamond Inc (NASDAQ:BDE)?

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, down by 9% from one quarter earlier. By comparison, 8 hedge funds held shares or bullish call options in BDE heading into this year. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Wynnefield Capital, led by Nelson Obus, holds the largest position in Black Diamond Inc (NASDAQ:BDE). Wynnefield Capital has a $6 million position in the stock, comprising 2% of its 13F portfolio. On Wynnefield Capital’s heels is Royce & Associates, led by Chuck Royce, which holds a $5.5 million position. Some other peers that are bullish contain D E Shaw, one of the biggest hedge funds in the world, Jim Simons’ Renaissance Technologies and Brian C. Freckmann’s Lyon Street Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.