The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Atlas Financial Holdings Inc (NASDAQ:AFH).

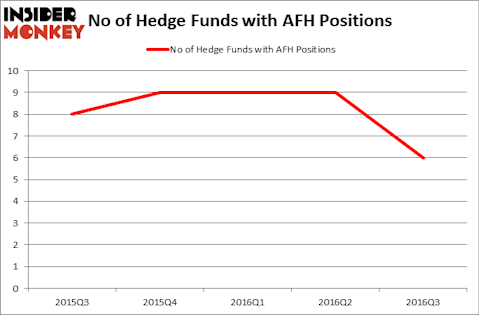

Atlas Financial Holdings Inc (NASDAQ:AFH) has experienced a decrease in activity from the world’s largest hedge funds recently. There were 9 hedge funds in our database with AFH holdings at the end of the second quarter, 3 more than there were a quarter later. At the end of this article we will also compare AFH to other stocks including Orion Marine Group, Inc. (NYSE:ORN), Senomyx Inc. (NASDAQ:SNMX), and Gladstone Capital Corporation (NASDAQ:GLAD) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

nito/Shutterstock.com

What does the smart money think about Atlas Financial Holdings Inc (NASDAQ:AFH)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a 33% fall from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AFH over the last 5 quarters, which was steady until the latest quarter. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Brian C. Freckmann’s Lyon Street Capital holds the biggest position in Atlas Financial Holdings Inc (NASDAQ:AFH). Lyon Street Capital has an $8.1 million position in the stock, comprising 3.9% of its 13F portfolio. Coming in second is Ron Bobman of Capital Returns Management, also with an $8.1 million position; 3.8% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions include Chuck Royce’s Royce & Associates, Renaissance Technologies, one of the largest hedge funds in the world, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Due to the fact that Atlas Financial Holdings Inc (NASDAQ:AFH) has experienced a decline in interest from the smart money, it’s safe to say that there lies a certain “tier” of hedge funds that slashed their full holdings heading into Q4. At the top of the heap, Richard Driehaus’ Driehaus Capital dropped the largest stake of all the hedgies watched by Insider Monkey, valued at an estimated $5.4 million in stock. Mark Coe’s fund, Coe Capital Management, also cut its stock, about $0.6 million worth.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Atlas Financial Holdings Inc (NASDAQ:AFH) but similarly valued. These stocks are Orion Marine Group, Inc. (NYSE:ORN), Senomyx Inc. (NASDAQ:SNMX), Gladstone Capital Corporation (NASDAQ:GLAD), and Arbutus Biopharma Corp (NASDAQ:ABUS). This group of stocks’ market caps are similar to AFH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ORN | 6 | 7268 | 0 |

| SNMX | 5 | 28673 | -2 |

| GLAD | 3 | 861 | 1 |

| ABUS | 11 | 88877 | -2 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $21 million in AFH’s case. Arbutus Biopharma Corp (NASDAQ:ABUS) is the most popular stock in this table. On the other hand Gladstone Capital Corporation (NASDAQ:GLAD) is the least popular one with only 3 bullish hedge fund positions. Atlas Financial Holdings Inc (NASDAQ:AFH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ABUS might be a better candidate to consider taking a long position in.

Disclosure: None