Hedge funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Amsurg Corp (NASDAQ:AMSG), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

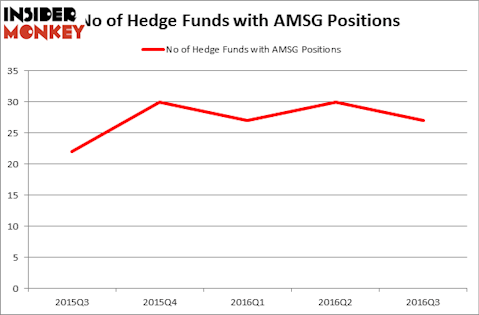

Amsurg Corp (NASDAQ:AMSG) was in 27 hedge funds’ portfolios at the end of September. AMSG investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. There were 30 hedge funds in our database with AMSG holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as IPG Photonics Corporation (NASDAQ:IPGP), Realogy Holdings Corp (NYSE:RLGY), and Cinemark Holdings, Inc. (NYSE:CNK) to gather more data points.

Follow Amsurg Corp (NASDAQ:AMSG)

Follow Amsurg Corp (NASDAQ:AMSG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Dmitry Kalinovsky/Shuteerstock.com

Hedge fund activity in Amsurg Corp (NASDAQ:AMSG)

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 10% decline from one quarter earlier, with hedge fund ownership being relatively stable over the past year. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Bloom Tree Partners, managed by Alok Agrawal, holds the largest position in Amsurg Corp (NASDAQ:AMSG). Bloom Tree Partners has a $72.2 million position in the stock, comprising 5.6% of its 13F portfolio. On Bloom Tree Partners’s heels is Viking Global, led by Andreas Halvorsen, holding a $70.2 million position. Other hedge funds and institutional investors with similar optimism comprise Robert Pohly’s Samlyn Capital, Dmitry Balyasny’s Balyasny Asset Management and Ken Griffin’s Citadel Investment Group.