We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards American Express Company (NYSE:AXP), and what that likely means for the prospects of the company and its stock.

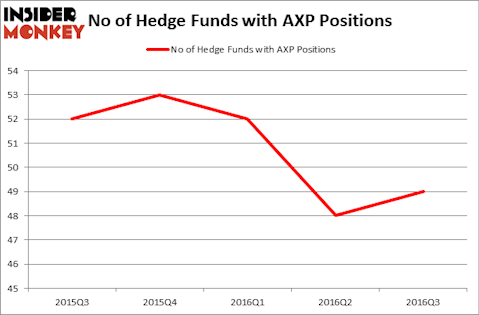

American Express Company (NYSE:AXP) investors should be aware of an increase in hedge fund interest of late. Heading into the fourth quarter of 2016, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a 2% rise from the second quarter of 2016. At the end of this article we will also compare AXP to other stocks including Abbott Laboratories (NYSE:ABT), Occidental Petroleum Corporation (NYSE:OXY), and Rio Tinto plc (ADR) (NYSE:RIO) to get a better sense of its popularity.

Follow American Express Co (NYSE:AXP)

Follow American Express Co (NYSE:AXP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively the most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

qvist/Shutterstock.com

What does the smart money think about American Express Company (NYSE:AXP)?

When looking at the institutional investors followed by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the most valuable position in American Express Company (NYSE:AXP), worth close to $9.71 billion, corresponding to 7.5% of its total 13F portfolio. The second most bullish fund manager is Fisher Asset Management, led by Ken Fisher, holding a $674.5 million position. Some other hedge funds and institutional investors that hold long positions contain Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC, Lee Ainslie’s Maverick Capital, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.