Does Horizon Bancorp (NASDAQ:HBNC) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

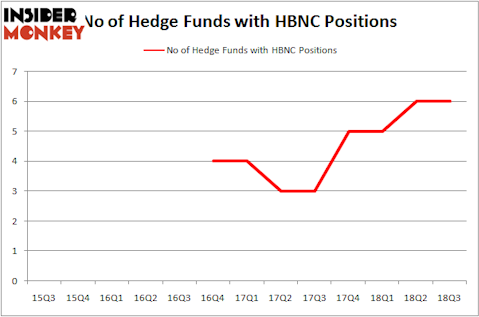

Horizon Bancorp (NASDAQ:HBNC) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 6 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Modine Manufacturing Company (NYSE:MOD), LeMaitre Vascular Inc (NASDAQ:LMAT), and Kornit Digital Ltd. (NASDAQ:KRNT) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to take a glance at the latest hedge fund action regarding Horizon Bancorp (NASDAQ:HBNC).

Hedge fund activity in Horizon Bancorp (NASDAQ:HBNC)

Heading into the fourth quarter of 2018, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the second quarter of 2018. On the other hand, there were a total of 5 hedge funds with a bullish position in HBNC at the beginning of this year. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Horizon Bancorp (NASDAQ:HBNC) was held by Renaissance Technologies, which reported holding $19.1 million worth of stock at the end of September. It was followed by Millennium Management with a $2.4 million position. Other investors bullish on the company included AQR Capital Management, Two Sigma Advisors, and D E Shaw.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: PDT Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Citadel Investment Group).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Horizon Bancorp (NASDAQ:HBNC) but similarly valued. We will take a look at Modine Manufacturing Company (NYSE:MOD), LeMaitre Vascular Inc (NASDAQ:LMAT), Kornit Digital Ltd. (NASDAQ:KRNT), and SunCoke Energy, Inc (NYSE:SXC). All of these stocks’ market caps are closest to HBNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MOD | 18 | 94051 | 1 |

| LMAT | 8 | 17922 | -2 |

| KRNT | 9 | 56673 | 3 |

| SXC | 21 | 115849 | 1 |

| Average | 14 | 71124 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $71 million. That figure was $24 million in HBNC’s case. SunCoke Energy, Inc (NYSE:SXC) is the most popular stock in this table. On the other hand LeMaitre Vascular Inc (NASDAQ:LMAT) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Horizon Bancorp (NASDAQ:HBNC) is even less popular than LMAT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.