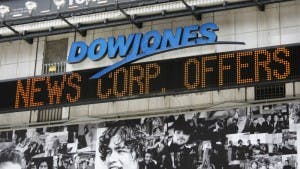

Today’s news from the financial markets was mixed regarding the U.S. economic outlook, with rising confidence levels from homebuilders inching closer to outright optimism. Moreover, prices at the wholesale level posted another sharp drop in April following a similar decline in March that brought year-over-year price gains to just 0.6%. Yet those developments were offset by a bigger-than-expected drop in industrial production and an unexpected decline in New York regional manufacturing activity, which helped restrain the stock market. As of 10:55 a.m. EDT, the Dow Jones Industrial Average (INDEXDJX:.DJI) are down a mere five points. The broader market is also flat, signaling a pause in the latest record-breaking run for the S&P 500 and Dow Jones Industrial Average (INDEXDJX:.DJI) in recent weeks.

Leading the decliners in the Dow Jones Industrial Average (INDEXDJX:.DJI) is Hewlett-Packard Company (NYSE:HPQ), which has fallen 2.1%. IDC released projections forecasting a slower rate of growth in worldwide IT spending. This could pose a threat to Hewlett-Packard Company (NYSE:HPQ)’s turnaround strategy, which hinges on its ability to widen its customer base and pull in revenue from a broader range of business segments. IDC blamed weak PC shipments for the slowdown, confirming a separate report showing a decline of more than 20% in Western European PC shipments during the first quarter of 2013 compared with the year-ago quarter. Hewlett-Packard Company (NYSE:HPQ) will need to accelerate its efforts to go beyond PCs if it wants to grow faster in the future.

Finally, outside the Dow Jones Industrial Average (INDEXDJX:.DJI), Zynga Inc (NASDAQ:ZNGA) has soared almost 7% after hedge fund Jana Partners reported taking a 25 million-share stake in the social-gaming company. With today marking the date on which money managers are required to disclose their holdings, you can expect to see a lot of attention on the moves influential Wall Street pros are making. For Zynga Inc (NASDAQ:ZNGA), a vote of confidence is much-needed support for a stock that has languished ever since its post-IPO optimism gave way to poor results.

The article Will the Dow’s Pause Refresh Bullish Investors? originally appeared on Fool.com and is written by Dan Caplinger.

Fool contributor Dan Caplinger has no position in any stocks mentioned. You can follow him on Twitter @DanCaplinger. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.