Should you be bullish on Assured Guaranty Ltd. (NYSE:AGO), Air Lease Corp (NYSE:AL), Capital One Financial Corp. (NYSE:COF), and KeyCorp (NYSE:KEY)? One fund that is bullish on all of these four companies is Tegean Capital Management. Tegean is a New York-based investment fund founded by Thomas G. Maheras in 2008. Tegean’s equity portfolio was valued at $136.91 million at the end of June. According to our calculations, Tegean Capital returned 11.94% from its 12 long positions in companies worth at least $1.0 billion in the third quarter.

The general perception in the media about hedge funds is getting negative amid losses, massive money pullout and high fee. However, our research has shown that hedge funds are still the best stock pickers if you know the right areas of their portfolios to look at. No less than 627 hedge funds in our database that had at least five long positions in companies valued at $1 billion or more returned 8.3% on average, a full 5.0 percentage points above the S&P 500 ETFs.

Rawpixel.com/Shutterstock.com

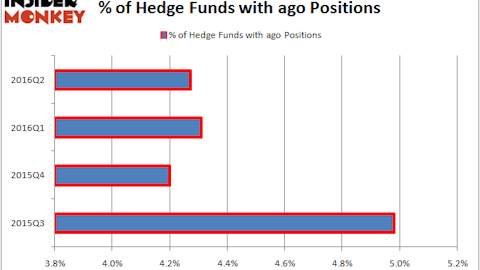

Tegean Capital Management went on a buying spree in the second quarter, upping its stake in Air Lease Corp (NYSE:AL) by 700%. The fund had 400,000 shares of the company, which were valued at over $10.71 million at the end of June. The investment was profitable as the stock returned 6.9% during the third quarter. At the end of June, 29 funds tracked by Insider Monkey held long positions in this stock, a change of 26% from the previous quarter. More specifically, Osterweis Capital Management was the largest shareholder of Air Lease Corp (NYSE:AL), with a stake worth $60.6 million reported as of the end of June. Trailing Osterweis Capital Management was Royce & Associates, which amassed a stake valued at $50.2 million. Selz Capital, Basswood Capital, and D E Shaw also held valuable positions in the company.

Follow Air Lease Corp (NYSE:AL)

Follow Air Lease Corp (NYSE:AL)

Receive real-time insider trading and news alerts

Tegean reported ownership of 400,000 shares of Assured Guaranty Ltd. (NYSE:AGO) as of the end of the second quarter; the stake was valued at $10.15 million. The stock gained 9.9% in the following three months. Among some of the funds that had long positions in Assured was Fine Capital Partners, which had a stake worth $78.2 million at the end of the second quarter. On the second spot was AQR Capital Management, which amassed $50.9 million worth of shares. Moreover, Alyeska Investment Group, Marshall Wace LLP, and Elm Ridge Capital were also bullish on Assured Guaranty Ltd. (NYSE:AGO).

Follow Assured Guaranty Ltd (NYSE:AGO)

Follow Assured Guaranty Ltd (NYSE:AGO)

Receive real-time insider trading and news alerts

Tegean Capital Management had 135,000 shares of Capital One Financial Corp. (NYSE:COF) in its equity portfolio at the end of June, which were valued at $8.57 million. Capital One’s stock delivered a gain of 13.8% in the three-month period ended September 30. Heading into the third quarter of 2016, a total of 46 investors from our database were long this stock, down by 2% over the quarter. Among these funds, Diamond Hill Capital held the number one position in Capital One Financial Corp. (NYSE:COF), which was valued at $329.2 million. Sitting at the No. 2 spot was GMT Capital, holding a $132.4 million position. Other members of the smart money that held long positions consisted of AQR Capital Management, Arrowstreet Capital, and Columbus Circle Investors.

Follow Capital One Financial Corp (NYSE:COF)

Follow Capital One Financial Corp (NYSE:COF)

Receive real-time insider trading and news alerts

Tegean Capital Management amassed 650,000 shares of KeyCorp (NYSE:KEY) at the end of the second quarter, the value of which was over $7.18 million. This investment also paid off, as the stock returned 10.9% during the third quarter. At the end of June, 46 investors followed by our team were bullish on this stock, an increase of 15% from the previous quarter. Among these funds, Millennium Management held the most valuable stake in KeyCorp (NYSE:KEY), which was worth $150 million at the end of the second quarter. On the second spot was Citadel Investment Group, which amassed $127.3 million worth of shares. Moreover, Pzena Investment Management, Long Pond Capital, and Two Sigma Advisors were also bullish on KeyCorp (NYSE:KEY).

Follow Keycorp W (NYSE:KEY)

Follow Keycorp W (NYSE:KEY)

Receive real-time insider trading and news alerts

Disclosure: none