Heartland Advisors, an investment management firm, published its “Heartland Value Plus Fund” fourth-quarter 2022 investor letter – a copy of which can be downloaded here. The fund has historically focused on identifying undervalued small companies with solid balance sheets that permit them to self-finance organic growth and strong free cash flow to raise their dividends over time. On top of that, the fund favor companies with compelling self-help strategies to provide an extra catalyst. Spare some time to check the fund’s top 5 holdings to have a clue about their top bets for 2022.

In its Q3 2022 investor letter, Heartland Value Plus Fund mentioned Powell Industries, Inc. (NASDAQ:POWL) and explained its insights for the company. Founded in 1947, Powell Industries, Inc. (NASDAQ:POWL) is a Houston, Texas-based electronics manufacturing company with a $537.7 million market capitalization. Powell Industries, Inc. (NASDAQ:POWL) delivered a 29.16% return since the beginning of the year, while its 12-month returns are up by 56.53%. The stock closed at $45.35 per share on February 6, 2023.

Here is what Heartland Value Plus Fund has to say about Powell Industries, Inc. (NASDAQ:POWL) in its Q3 2022 investor letter:

“It’s more accurate to say we favor companies with defensive characteristics that are likely to be secular winners, even if the economy doesn’t offer much of a tailwind. And once the next cycle begins, these are companies that stand to benefit as the economy re-accelerates.

An example is Powell Industries, Inc. (NASDAQ:POWL), which manufactures electrical power distribution equipment and components used in pipelines, offshore drilling platforms, data centers, and large industrial facilities. After experiencing a downturn along with oil prices in recent years, Powell is now enjoying a tailwind from energy’s rebound, especially liquified natural gas related. Order activity, in fact, has risen for six consecutive quarters. And for the full year, new orders rose 78% compared to fiscal 2021.

Powell enjoys self-help catalysts as well. The company, with significant insider ownership, has been focused on internal capital allocation moves lately to position itself for a more profitable future. In fiscal year 2022, for instance, the company divested a low-margin industrial valve repair division within Powell Canada. At the same time, the company has been investing in its higher-margin services business to improve its overall mix of revenue sources.

Yet, very few sell-side analysts cover the stock, and those who do, don’t seem to appreciate the internal and external tailwinds the company enjoys. This is where our selectivity comes into focus.

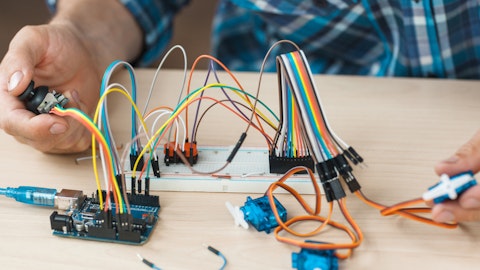

Golubovy/Shutterstock.com

Our calculations show that Powell Industries, Inc. (NASDAQ:POWL) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. Powell Industries, Inc. (NASDAQ:POWL) was in 6 hedge fund portfolios at the end of the second quarter of 2022, compared to 8 funds in the previous quarter. Powell Industries, Inc. (NASDAQ:POWL) delivered a 75.24% return in the past 3 months.

In (date of publication), we also shared another hedge fund’s views on Powell Industries, Inc. (NASDAQ:POWL) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters Q4 2022 page.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.