Baron Funds, an asset management company, released its “Baron Discovery Fund” second quarter 2022 investor letter. A copy of the same can be downloaded here. The fund was down 22.66% in the second quarter, 3.41% below its benchmark index, the Russell 2000 Growth Index. The firm focuses more on secular growth stories instead of cyclical companies. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022.

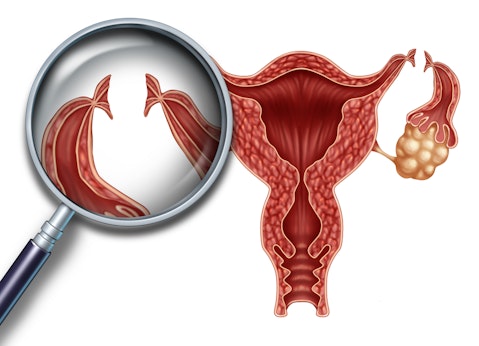

Baron Funds discussed stocks like Progyny, Inc. (NASDAQ:PGNY) in the second quarter investor letter. Headquartered in New York, New York, Progyny, Inc. (NASDAQ:PGNY) is a fertility benefits management company. On September 12, 2022, Progyny, Inc. (NASDAQ:PGNY) stock closed at $43.86 per share. One-month return of Progyny, Inc. (NASDAQ:PGNY) was -4.82% and its shares lost 24.07% of their value over the last 52 weeks. Progyny, Inc. (NASDAQ:PGNY) has a market capitalization of $4.039 billion.

Here is what Baron Funds specifically said about Progyny, Inc. (NASDAQ:PGNY) in its Q2 2022 investor letter:

“Shares of Progyny, Inc. (NASDAQ:PGNY), the U.S.’s leading provider of employer-sponsored fertility benefits, dropped in the second quarter, along with the broad sell-off in high-multiple growth stocks. Progyny is profitable and self- financing. The company delivered a beat and raise first quarter with optimistic management commentary regarding the early 2023 selling season. Nevertheless, investors seemed more focused on concerns of greater competition, the pace of post-COVID utilization, recession fears, and the possible ramifications of Roe vs. Wade being overturned. We believe these concerns are overdone.

We believe that the pace of employer-sponsored fertility benefit adoption is accelerating, and Progyny is differentiated by having the most comprehensive offering and broadest network in the market, and that its utilization is normalizing off the COVID trough. With regard to Roe, management has conservatively pegged only 3% of revenue exposed to states that have “trigger laws” which automatically restricted or banned abortions when Roe was overturned.

Texas has a trigger law, but actually mandates IVF coverage and has specific language in its laws that should allow doctors to continue to deliver IVF services without fear of legal exposure.”

Lightspring/Shutterstock.com

Progyny, Inc. (NASDAQ:PGNY) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 21 hedge fund portfolios held Progyny, Inc. (NASDAQ:PGNY) at the end of the second quarter which was 18 in the previous quarter.

We discussed Progyny, Inc. (NASDAQ:PGNY) in another article and shared Polen Capital’s views on the company. In addition, please check out our hedge fund investor letters Q2 2022 page for more investor letters from hedge funds and other leading investors.

Disclosure: None. This article is originally published at Insider Monkey.