Platinum Asset Management, an investment management company, released its Q3 2025 investor letter for “Platinum International Technology Fund”. A copy of the letter can be downloaded here. The fund was up 6% in the third quarter, driven by strong performance from AI-oriented holdings. The portfolio holds around 30% of its stake in AI infrastructure stocks and is positioned to benefit from significant investment in the AI build-out. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2025.

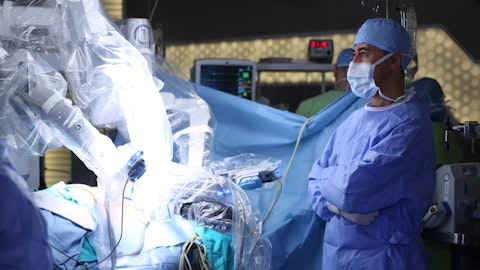

In its third-quarter 2025 investor letter, Platinum International Technology Fund highlighted stocks such as Intuitive Surgical, Inc. (NASDAQ:ISRG). Intuitive Surgical, Inc. (NASDAQ:ISRG) manufactures and markets products that help physicians and healthcare providers improve the quality of and access to minimally invasive care. The one-month return of Intuitive Surgical, Inc. (NASDAQ:ISRG) was -1.78%, and its shares gained 5.34% of their value over the last 52 weeks. On December 16, 2025, Intuitive Surgical, Inc. (NASDAQ:ISRG) stock closed at $554.58 per share, with a market capitalization of $198.804 billion.

Platinum International Technology Fund stated the following regarding Intuitive Surgical, Inc. (NASDAQ:ISRG) in its third quarter 2025 investor letter:

“We increased our position in Intuitive Surgical, Inc. (NASDAQ:ISRG) from 1.5% to 3%. The stock is back to April lows due to a small systems placement miss outside of the US and competition from lower priced recycled Da Vinci surgical instruments. On the former, we suspect that this is due to customers holding back orders until the launch of Da Vinci 5 which has now received regulatory approval in Europe and Japan. We are less worried about competition from recycled instruments as our research indicates surgeons are the decision makers and prefer Intuitive instruments due to quality, safety and reliability. We do not believe the cost savings from switching is meaningful versus the risks as it only works out to be ~$50 per surgery.”

Intuitive Surgical, Inc. (NASDAQ:ISRG) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 99 hedge fund portfolios held Intuitive Surgical, Inc. (NASDAQ:ISRG) at the end of the third quarter, which was 107 in the previous quarter. While we acknowledge the risk and potential of Intuitive Surgical, Inc. (NASDAQ:ISRG) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Intuitive Surgical, Inc. (NASDAQ:ISRG) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Intuitive Surgical, Inc. (NASDAQ:ISRG) and shared Brown Advisory Large-Cap Growth Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.