Carillon Tower Advisers, an investment management company, released its fourth-quarter 2025 investor letter “Carillon Eagle Growth & Income Fund”. A copy of the letter can be downloaded here. 2025 marked a positive period for the equity market. The S&P 500 Index returned 2.7% in Q4 and finished the year up 17.9%. The year started with potential disruptions and heightened volatility, while it ended with optimism driven by strong AI investment, clarity in policies, and U.S. Federal Reserve (Fed) interest rate cuts. The market’s performance was significantly affected by the communication services and technology sectors. From a return‑driver standpoint, the market expansion in the year was driven by earnings growth. The firm observes favorable conditions as 2026 approaches, and believes it can achieve another year of strong equity returns. The Fund holds net assets of $493.06 million across 48 holdings. Please review the Strategy’s top five holdings to gain insights into their key selections for 2025.

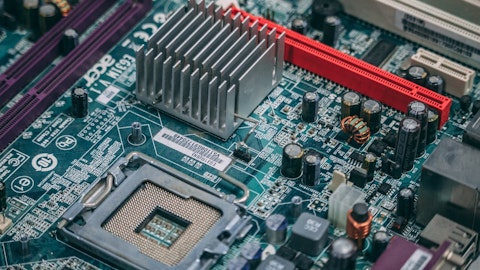

In its fourth-quarter 2025 investor letter, Carillon Eagle Growth & Income Fund highlighted stocks like Analog Devices, Inc. (NASDAQ:ADI). Analog Devices, Inc. (NASDAQ:ADI) is a semiconductor company that designs and manufactures integrated circuits (ICs), software, and subsystems products. On February 11, 2026, Analog Devices, Inc. (NASDAQ:ADI) stock closed at $337.00 per share. One-month return of Analog Devices, Inc. (NASDAQ:ADI) was 13.30%, and its shares are up 63.50% over the past twelve months. Analog Devices, Inc. (NASDAQ:ADI) has a market capitalization of $167.508 billion.

Carillon Eagle Growth & Income Fund stated the following regarding Analog Devices, Inc. (NASDAQ:ADI) in its fourth quarter 2025 investor letter:

“Analog Devices, Inc. (NASDAQ:ADI) pushed toward new all‑time highs after solid earnings gave investors’ confidence that the analog cycle is now beyond its bottom. We believe the cycle is on track for an early recovery in 2026.”

Analog Devices, Inc. (NASDAQ:ADI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 84 hedge fund portfolios held Analog Devices, Inc. (NASDAQ:ADI) at the end of the third quarter, up from 79 in the previous quarter. While we acknowledge the risk and potential of Analog Devices, Inc. (NASDAQ:ADI) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Analog Devices, Inc. (NASDAQ:ADI) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Analog Devices, Inc. (NASDAQ:ADI) and shared stock picks from Goldman Sachs semiconductor stocks. In addition, please check out our hedge fund investor letters Q4 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.