Madison Investments, an investment advisor, released its “Madison Investors Fund” first-quarter 2024 investor letter. A copy of the same can be downloaded here. In the first quarter, the fund (Class Y) returned 9.63% compared to a 10.56% return for the S&P 500 index. The business remains dedicated to its more than two-decades-old strategy of investing in long-term, competitively advantaged, expanding firms at acceptable valuations, even if market performance has been robust over the past year and valuations have generally returned to earlier highs. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Madison Investors Fund featured stocks like Analog Devices, Inc. (NASDAQ:ADI) in the first quarter 2024 investor letter. Headquartered in Wilmington, Massachusetts, Analog Devices, Inc. (NASDAQ:ADI) designs, manufactures, and tests integrated circuits (ICs), software, and subsystems. On April 17, 2024, Analog Devices, Inc. (NASDAQ:ADI) stock closed at $189.43 per share. One-month return of Analog Devices, Inc. (NASDAQ:ADI) was -2.93%, and its shares gained 1.31% of their value over the last 52 weeks. Analog Devices, Inc. (NASDAQ:ADI) has a market capitalization of $93.94 billion.

Madison Investors Fund stated the following regarding Analog Devices, Inc. (NASDAQ:ADI) in its first quarter 2024 investor letter:

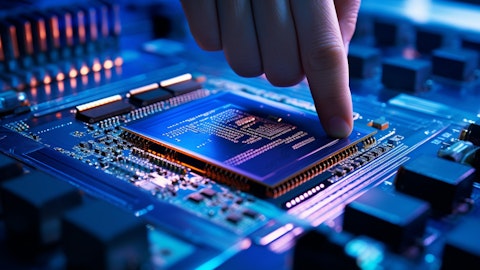

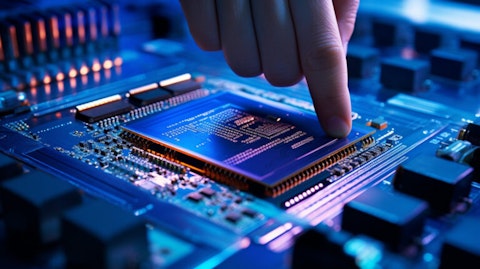

“At semiconductor manufacturer Analog Devices, Inc. (NASDAQ:ADI), end-market demand continues to decline as customers and distributors reduce inventory after building it up during the supply chain induced shortages a few years back. Despite these near-term trends, we remain confident that large parts of the global economy will continue to digitize over the long-term, thereby driving strong demand for analog semiconductor chips.”

A close up view of mmWave Integrated Circuits with a technician pointing out the intricate components.

Analog Devices, Inc. (NASDAQ:ADI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, Analog Devices, Inc. (NASDAQ:ADI) was held by 62 hedge fund portfolios, compared to 64 in the previous quarter, according to our database.

We previously discussed Analog Devices, Inc. (NASDAQ:ADI) in another article, where we shared the list of best nanotechnology stocks to invest in. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 10 Best Alternatives to Nursing Homes and Assisted Living

- 10 Most Undervalued Stocks to Buy for Under $20

- Billionaire Leon Cooperman’s Family, Children and Investments

Disclosure: None. This article is originally published at Insider Monkey.