Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

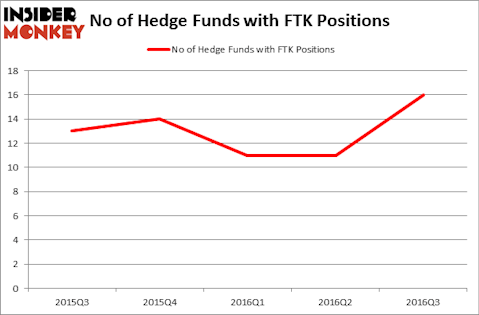

This article will discuss the latest hedge fund activity surrounding Flotek Industries Inc (NYSE:FTK). During the third quarter, the number of funds tracked by us bullish on FTK surged by five to 16. At the end of this article we will also compare FTK to other stocks including National Western Life Insurance Company (NASDAQ:NWLI), Re/Max Holdings Inc (NYSE:RMAX), and Fifth Street Finance Corp. (NASDAQ:FSC) to get a better sense of its popularity.

Follow Flotek Industries Inc (NYSE:FTK)

Follow Flotek Industries Inc (NYSE:FTK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

KPG Ivary/Shutterstock.com

Now, let’s take a look at the key action encompassing Flotek Industries Inc (NYSE:FTK).

What have hedge funds been doing with Flotek Industries Inc (NYSE:FTK)?

Heading into the fourth quarter of 2016, 16 funds tracked by Insider Monkey were long Flotek Industries, a rise of 45% from the previous quarter. The graph below displays the number of hedge funds with bullish position in FTK over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jeffrey Gates’ Gates Capital Management holds the most valuable position in Flotek Industries Inc (NYSE:FTK) which is valued at $81.3 million, comprising 2.9% of its 13F portfolio. The second most bullish fund manager is Israel Englander of Millennium Management, with a $53.7 million position. Remaining members of the smart money that are bullish comprise William Harnisch’s Peconic Partners LLC, Solomon Kumin’s Folger Hill Asset Management, and Andy Redleaf’s Whitebox Advisors. We’d like to point out an interesting observation. Three of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Folger Hill Asset Management created the most valuable position in Flotek Industries Inc (NYSE:FTK) which had $5.1 million invested in the company at the end of the quarter. Andy Redleaf’s Whitebox Advisors also initiated a $3.5 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Till Bechtolsheimer’s Arosa Capital Management, and Robert Vollero and Gentry T. Beach’s Vollero Beach Capital Partners.

Let’s now take a look at hedge fund activity in other stocks similar to Flotek Industries Inc (NYSE:FTK). We will take a look at National Western Life Insurance Company (NASDAQ:NWLI), Re/Max Holdings Inc (NYSE:RMAX), Fifth Street Finance Corp. (NASDAQ:FSC), and Middlesex Water Company (NASDAQ:MSEX). This group of stocks’ market caps are closest to FTK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NWLI | 7 | 13390 | 0 |

| RMAX | 4 | 25202 | -2 |

| FSC | 11 | 15348 | 0 |

| MSEX | 7 | 30579 | -2 |

As you can see these stocks had an average of seven funds with bullish positions and the average amount invested in these stocks was $21 million, which is lower than the $168 million figure in FTK’s case. Fifth Street Finance Corp. (NASDAQ:FSC) is the most popular stock in this table. On the other hand Re/Max Holdings Inc (NYSE:RMAX) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Flotek Industries Inc (NYSE:FTK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None