Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Par Pacific Holdings, Inc. (NYSEMKT:PARR).

Par Pacific Holdings, Inc. (NYSEMKT:PARR) experienced an increase in support from the world’s most successful money managers last quarter. There were 16 hedge funds in our database with PARR holdings at the end of September. At the end of this article we will also compare PARR to other stocks including MarineMax, Inc. (NYSE:HZO), ShoreTel, Inc. (NASDAQ:SHOR), and ChipMOS Technologies (Bermuda) Ltd (NASDAQ:IMOS) to get a better sense of its popularity.

Follow Par Pacific Holdings Inc. (NYSE:PARR)

Follow Par Pacific Holdings Inc. (NYSE:PARR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

anekoho/Shutterstock.com

With all of this in mind, let’s review the latest action encompassing Par Pacific Holdings, Inc. (NYSEMKT:PARR).

Hedge fund activity in Par Pacific Holdings, Inc. (NYSEMKT:PARR)

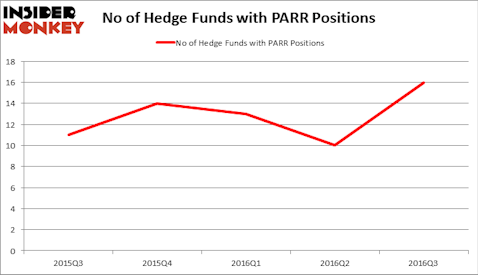

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in Par Pacific Holdings, up by six funds from the previous quarter. The graph below displays the number of hedge funds with bullish position in PARR over the last five quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Whitebox Advisors, led by Andy Redleaf, holds the number one position in Par Pacific Holdings, Inc. (NYSEMKT:PARR). Whitebox Advisors has a $104.6 million position in the stock, comprising 4.4% of its 13F portfolio. Sitting at the No. 2 spot is Peter S. Park’s Park West Asset Management, holding a $16.4 million position; the fund has 1.5% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions comprise Alec Litowitz and Ross Laser’s Magnetar Capital, Michael Kaine’s Numina Capital, and Murray Stahl’s Horizon Asset Management. We should note that Whitebox Advisors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.