Meridian Funds, managed by ArrowMark Partners, released its “Meridian Contrarian Fund” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. The U.S. equity market showcased a significant recovery during the quarter, rising 23% from low to end the quarter at a record high. U.S. large-cap stocks gained 11.1% in the quarter, and within the large-cap category, growth stocks outperformed value stocks. In this environment, the fund returned 16.42% (net) during the quarter, exceeding 8.59% returns of the Russell 2500 Index and 7.29% returns of the secondary benchmark, the Russell 2500 Value Index. In addition, please check the fund’s top five holdings to know its best picks in 2025.

In its second-quarter 2025 investor letter, Meridian Contrarian Fund highlighted stocks such as Cameco Corporation (NYSE:CCJ). Cameco Corporation (NYSE:CCJ) is a leading uranium-producing company. One-month return of Cameco Corporation (NYSE:CCJ) was 10.69%, and its shares gained 78.53% of their value over the last 52 weeks. On September 25, 2025, Cameco Corporation (NYSE:CCJ) stock closed at $85.66 per share, with a market capitalization of $37.418 billion.

Meridian Contrarian Fund stated the following regarding Cameco Corporation (NYSE:CCJ) in its second quarter 2025 investor letter:

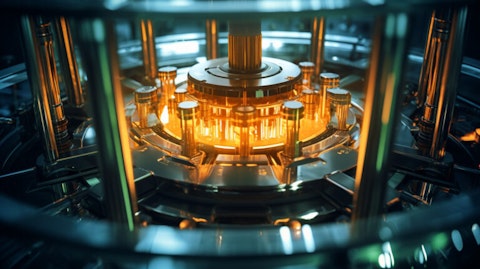

“Cameco Corporation (NYSE:CCJ) is a global leader in the mining, fabrication, and refinement of uranium products for nuclear power plants around the world. The company also has exposure to the construction of new nuclear power capacity through its Westinghouse unit. We view Cameco as a best-in-class operator with world-leading reserves, a low-cost production profile, and reliable, proven technology. After years of being out of favor following the 2011 Fukushima nuclear disaster, Cameco became increasingly attractive as global uranium production fell below demand. We invested in 2020 based on the belief (as referenced in the Q3 ’23 investor letter) that uranium prices would recover and that interest in nuclear power would reaccelerate, providing upside optionality. While not without volatility, this thesis has played out largely as we envisioned and has since gained broader investor acceptance. Despite the growing interest in the theme, we believe Cameco remains in the early stages of a long-term structural turnaround. The stock rebounded strongly during the quarter as momentum around nuclear power accelerated globally from governments, utilities, and major technology firms. We both bought and sold shares in the quarter and were net sellers into strength as part of our risk management process.”

Cameco Corporation (NYSE:CCJ) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 77 hedge fund portfolios held Cameco Corporation (NYSE:CCJ) at the end of the second quarter, up from 58 in the previous quarter. While we acknowledge the risk and potential of Cameco Corporation (NYSE:CCJ) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Cameco Corporation (NYSE:CCJ) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Cameco Corporation (NYSE:CCJ) and shared stocks on the rise. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.