The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Nordson Corporation (NASDAQ:NDSN), and what that likely means for the prospects of the company and its stock.

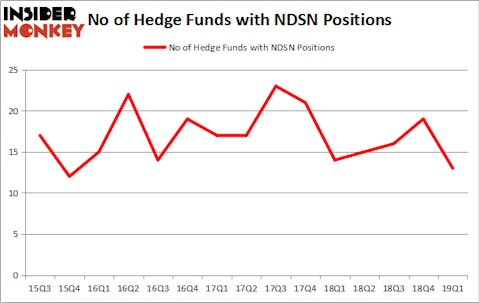

Nordson Corporation (NASDAQ:NDSN) investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. NDSN was in 13 hedge funds’ portfolios at the end of March. There were 19 hedge funds in our database with NDSN holdings at the end of the previous quarter. Our calculations also showed that NDSN isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action encompassing Nordson Corporation (NASDAQ:NDSN).

How have hedgies been trading Nordson Corporation (NASDAQ:NDSN)?

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -32% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NDSN over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the number one position in Nordson Corporation (NASDAQ:NDSN). Royce & Associates has a $17.1 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is GAMCO Investors, led by Mario Gabelli, holding a $5.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Israel Englander’s Millennium Management, and Curtis Schenker and Craig Effron’s Scoggin.

Judging by the fact that Nordson Corporation (NASDAQ:NDSN) has faced declining sentiment from the entirety of the hedge funds we track, we can see that there were a few funds that elected to cut their entire stakes last quarter. At the top of the heap, Robert Joseph Caruso’s Select Equity Group cut the largest position of all the hedgies tracked by Insider Monkey, worth about $7.3 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also dumped its stock, about $4.2 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 6 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Nordson Corporation (NASDAQ:NDSN) but similarly valued. We will take a look at L Brands Inc (NYSE:LB), NICE Ltd. (NASDAQ:NICE), SL Green Realty Corp (NYSE:SLG), and Amdocs Limited (NASDAQ:DOX). This group of stocks’ market caps are closest to NDSN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LB | 32 | 709689 | -3 |

| NICE | 17 | 236328 | 2 |

| SLG | 19 | 214863 | -3 |

| DOX | 26 | 619930 | 2 |

| Average | 23.5 | 445203 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $445 million. That figure was $33 million in NDSN’s case. L Brands Inc (NYSE:LB) is the most popular stock in this table. On the other hand NICE Ltd. (NASDAQ:NICE) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Nordson Corporation (NASDAQ:NDSN) is even less popular than NICE. Hedge funds dodged a bullet by taking a bearish stance towards NDSN. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately NDSN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); NDSN investors were disappointed as the stock returned 0.6% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.