After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Leggett & Platt, Inc. (NYSE:LEG).

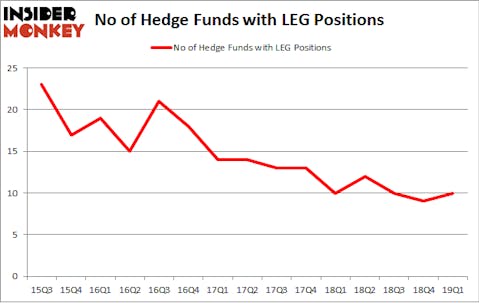

Leggett & Platt, Inc. (NYSE:LEG) was in 10 hedge funds’ portfolios at the end of the first quarter of 2019. LEG investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. There were 9 hedge funds in our database with LEG holdings at the end of the previous quarter. Our calculations also showed that leg isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action regarding Leggett & Platt, Inc. (NYSE:LEG).

How are hedge funds trading Leggett & Platt, Inc. (NYSE:LEG)?

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LEG over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Joel Greenblatt’s Gotham Asset Management has the largest position in Leggett & Platt, Inc. (NYSE:LEG), worth close to $11.2 million, accounting for 0.2% of its total 13F portfolio. The second largest stake is held by Noam Gottesman of GLG Partners, with a $4.4 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish encompass Ken Griffin’s Citadel Investment Group, Jeffrey Talpins’s Element Capital Management and Matthew Hulsizer’s PEAK6 Capital Management.

As aggregate interest increased, key money managers have been driving this bullishness. Element Capital Management, managed by Jeffrey Talpins, established the most outsized position in Leggett & Platt, Inc. (NYSE:LEG). Element Capital Management had $2.8 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $1.7 million investment in the stock during the quarter. The following funds were also among the new LEG investors: Israel Englander’s Millennium Management and Michael Gelband’s ExodusPoint Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Leggett & Platt, Inc. (NYSE:LEG) but similarly valued. We will take a look at Equitrans Midstream Corporation (NYSE:ETRN), WPX Energy Inc (NYSE:WPX), Algonquin Power & Utilities Corp. (NYSE:AQN), and Grand Canyon Education Inc (NASDAQ:LOPE). All of these stocks’ market caps match LEG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETRN | 19 | 559560 | -9 |

| WPX | 42 | 794081 | -4 |

| AQN | 12 | 54770 | 3 |

| LOPE | 26 | 151266 | 5 |

| Average | 24.75 | 389919 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $390 million. That figure was $28 million in LEG’s case. WPX Energy Inc (NYSE:WPX) is the most popular stock in this table. On the other hand Algonquin Power & Utilities Corp. (NYSE:AQN) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Leggett & Platt, Inc. (NYSE:LEG) is even less popular than AQN. Hedge funds dodged a bullet by taking a bearish stance towards LEG. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately LEG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); LEG investors were disappointed as the stock returned -8.6% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.