The market has been volatile in the last 6 months as the Federal Reserve continued its rate hikes and then abruptly reversed its stance and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q4 and the beginning of Q1. In this article, we analyze what the smart money thinks of FMC Corporation (NYSE:FMC) and find out how it is affected by hedge funds’ moves.

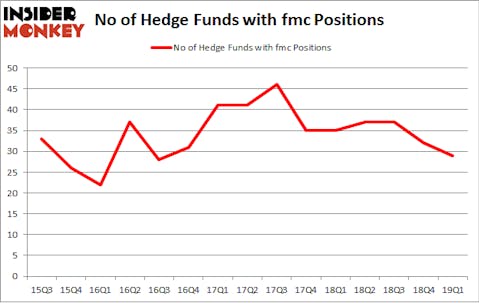

Is FMC Corporation (NYSE:FMC) a healthy stock for your portfolio? Money managers are taking a pessimistic view. The number of bullish hedge fund positions fell by 3 in recent months. Our calculations also showed that fmc isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be worthless, old investment tools of yesteryear. While there are more than 8000 funds in operation at the moment, Our experts choose to focus on the leaders of this group, about 750 funds. These hedge fund managers preside over the lion’s share of the hedge fund industry’s total capital, and by monitoring their highest performing picks, Insider Monkey has come up with various investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s take a glance at the fresh hedge fund action surrounding FMC Corporation (NYSE:FMC).

How are hedge funds trading FMC Corporation (NYSE:FMC)?

At Q1’s end, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the fourth quarter of 2018. By comparison, 35 hedge funds held shares or bullish call options in FMC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in FMC Corporation (NYSE:FMC) was held by Glenview Capital, which reported holding $704.2 million worth of stock at the end of March. It was followed by Thunderbird Partners with a $224.6 million position. Other investors bullish on the company included Holocene Advisors, Cardinal Capital, and York Capital Management.

Seeing as FMC Corporation (NYSE:FMC) has faced declining sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of funds that elected to cut their entire stakes in the third quarter. It’s worth mentioning that Stephen J. Errico’s Locust Wood Capital Advisers cut the largest position of the 700 funds tracked by Insider Monkey, valued at about $25.1 million in stock. Jay Petschek and Steven Major’s fund, Corsair Capital Management, also dumped its stock, about $17 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to FMC Corporation (NYSE:FMC). These stocks are Camden Property Trust (NYSE:CPT), Fidelity National Financial Inc (NYSE:FNF), NVR, Inc. (NYSE:NVR), and China Eastern Airlines Corporation Limited (NYSE:CEA). This group of stocks’ market values match FMC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPT | 24 | 428359 | 5 |

| FNF | 30 | 427989 | 2 |

| NVR | 25 | 883152 | -6 |

| CEA | 1 | 1543 | -1 |

| Average | 20 | 435261 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $435 million. That figure was $1272 million in FMC’s case. Fidelity National Financial Inc (NYSE:FNF) is the most popular stock in this table. On the other hand China Eastern Airlines Corporation Limited (NYSE:CEA) is the least popular one with only 1 bullish hedge fund positions. FMC Corporation (NYSE:FMC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately FMC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FMC were disappointed as the stock returned -4.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.