It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards A. O. Smith Corporation (NYSE:AOS) changed during the first quarter.

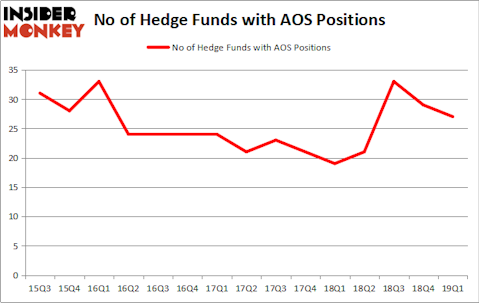

A. O. Smith Corporation (NYSE:AOS) has seen a decrease in enthusiasm from smart money of late. AOS was in 27 hedge funds’ portfolios at the end of the first quarter of 2019. There were 29 hedge funds in our database with AOS positions at the end of the previous quarter. Our calculations also showed that AOS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action encompassing A. O. Smith Corporation (NYSE:AOS).

What have hedge funds been doing with A. O. Smith Corporation (NYSE:AOS)?

At the end of the first quarter, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AOS over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Impax Asset Management was the largest shareholder of A. O. Smith Corporation (NYSE:AOS), with a stake worth $206.6 million reported as of the end of March. Trailing Impax Asset Management was Two Sigma Advisors, which amassed a stake valued at $70.5 million. Balyasny Asset Management, Marshall Wace LLP, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since A. O. Smith Corporation (NYSE:AOS) has faced a decline in interest from hedge fund managers, we can see that there lies a certain “tier” of hedge funds who sold off their positions entirely last quarter. It’s worth mentioning that Robert Joseph Caruso’s Select Equity Group said goodbye to the largest position of all the hedgies watched by Insider Monkey, totaling an estimated $30.6 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund dropped about $11.2 million worth. These moves are important to note, as total hedge fund interest fell by 2 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to A. O. Smith Corporation (NYSE:AOS). We will take a look at National Retail Properties, Inc. (NYSE:NNN), LKQ Corporation (NASDAQ:LKQ), Reinsurance Group of America Inc (NYSE:RGA), and Molina Healthcare, Inc. (NYSE:MOH). All of these stocks’ market caps are closest to AOS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NNN | 12 | 248443 | -3 |

| LKQ | 43 | 1068048 | 3 |

| RGA | 23 | 409256 | -4 |

| MOH | 30 | 1026129 | 3 |

| Average | 27 | 687969 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $688 million. That figure was $475 million in AOS’s case. LKQ Corporation (NASDAQ:LKQ) is the most popular stock in this table. On the other hand National Retail Properties, Inc. (NYSE:NNN) is the least popular one with only 12 bullish hedge fund positions. A. O. Smith Corporation (NYSE:AOS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately AOS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AOS investors were disappointed as the stock returned -22.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.