Brown Advisory, an investment management company, released its “Brown Advisory Global Leaders Strategy” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. The strategy focused on delivering strong long-term performance by investing in a focused portfolio of companies that solve customer problems and provide good returns for shareholders. The strategy outperformed its benchmark during the quarter, driven by investment selection within Information Technology and Industrials. In addition, please check the fund’s top five holdings to know its best picks in 2025.

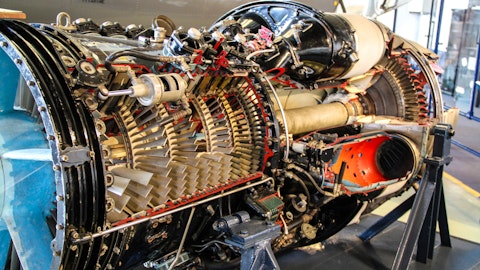

In its second-quarter 2025 investor letter, Brown Advisory Global Leaders Strategy highlighted stocks such as GE Aerospace (NYSE:GE). General Electric Company, operating under the name GE Aerospace (NYSE:GE), develops and manufactures engines for commercial and military aircraft. The one-month return of GE Aerospace (NYSE:GE) was 9.89%, and its shares gained 58.72% of their value over the last 52 weeks. On September 22, 2025, GE Aerospace (NYSE:GE) stock closed at $301.02 per share, with a market capitalization of $289.861 billion.

Brown Advisory Global Leaders Strategy stated the following regarding GE Aerospace (NYSE:GE) in its second quarter 2025 investor letter:

“GE Aerospace (NYSE:GE): Designs, develops, manufactures and services aircraft engines for commercial airframes & defense jet engines, avionics & power systems. GE Aerospace continued to see increased contribution from the profitable aftermarket business. Despite the largest direct exposure to tariffs within the portfolio GE Aerospace has shown its pricing power. There is also optimism about an aerospace trade deal intensely discussed at the Paris Air Show we attended.”

GE Aerospace (NYSE:GE) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 100 hedge fund portfolios held GE Aerospace (NYSE:GE) at the end of the second quarter, down from 104 in the previous quarter. While we acknowledge the risk and potential of GE Aerospace (NYSE:GE) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than GE Aerospace (NYSE:GE) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered GE Aerospace (NYSE:GE) and shared the list of best defense stocks to buy. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.