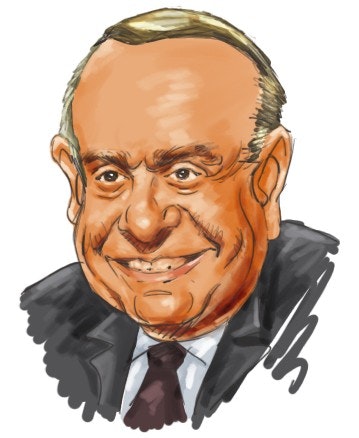

We are in the middle of a massive monetary and fiscal stimulus cycle which is already showing its effects on forex markets. In this article, we talked about billionaire Lee Cooperman’s massive inflation predictions and presented his favorite investment ideas heading into 2021. Click to skip ahead and see Billionaire Lee Cooperman’s 5 Favorite Stocks Heading Into 2021.

Leon Cooperman, the self-made billionaire and the chairman and CEO of investment firm Omega Advisors, believes stock markets are accurately priced. The 77 years old living legend has turned his hedge fund into a family office in 2018, saying I can’t chase S&P 500 for the rest of my life. Cooperman’s hedge fund Omega Advisors have generated more than 12% annualized returns since inception through 2018.

He worked for Goldman Sachs for 25 years before establishing Omega Advisors in 1991. The billionaire investor has recently expressed concerns over the rising US debt on a TV show. Meanwhile, Cooperman also expressed confidence in gold markets for the first time in his investing career. The gold price has hit new record levels in 2020, thanks to investors’ move towards safe-haven assets in the wake of pandemic and concerns over the US dollar value depreciation.

“I bought gold for the first time in my life. I understand the case for gold. We’re on the way to some banana republic situation. Nobody’s worrying about the debt that’s being created.”

The investing guru particularly focuses on the fundamentals of companies when making buying or selling decisions. His investment philosophy has also been concentrated on macro trends.

The billionaire legend has kept investments in energy companies despite historic down cycles in 2020 amid pandemic and slowing demand. Cooperman claims that oil prices will trade around $60 a barrel. Crude oil prices are currently trading around $48 a barrel, representing a substantial recovery after going negative during the second quarter of 2020.

The legendary investor also believes in market trends. He sold old-fashioned banking giant JP Morgan’s (NYSE: JPM) stake in the latest quarter, according to 13F filings. However, Leon Cooperman has expressed strong confidence in the emerging financial services technology providers like Fiserv (NASDAQ: FISV) and Mr. Cooper Group Inc (NASDAQ: COOP). The legendary investor has also been enhancing stakes in the fastest growing technology and communication sector.

Portfolio diversification is also among the key factors when it comes to beating the markets, according to the billionaire Leon Cooperman.

Omega Advisors family office has diversified its portfolio towards several sectors including financial services, energy, technology, materials, healthcare, and communication services. The financial sector accounts for around 23% of the overall portfolio, while the technology and communication sectors stand around 17% and 11%, respectively. The top ten holdings represent 63.7% of the portfolio.

Leon Cooperman has made several changes in the portfolio in the latest quarter to align with the business environment. The family office fund has sold out 6 stocks and reduced stakes in 9 stocks. On the other hand, the legendary investor purchased 7 stocks and added to its 13 existing positions. At the end of the third quarter, Omega’s equity portfolio market value stood around $1.017 billion.

While Leon Cooperman’s reputation remains intact, the same can’t be said of the hedge fund industry as a whole, as its reputation has been tarnished in the last decade during which its hedged returns couldn’t keep up with the unhedged returns of the market indices. On the other hand, Insider Monkey’s research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 78 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that significantly underperformed the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 13% through November 16. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. You can subscribe to our free newsletter on our homepage to receive our stories in your inbox.

It’s worth watching how the legendary investor has been playing with the stock market when the valuations of the majority of stocks are at record levels. We decided to review billionaire Leon Cooperman’s favorite stocks heading into 2021 and in the midst of massive fiscal and monetary stimulus.

10. Athene Holding Ltd. (NYSE:ATH)

The mid-cap life and health insurance firm Athene Holding Ltd. (NYSE: ATH) is among the favorite stocks billionaire Leon Cooperman’s like to hold in a portfolio heading into 2021. The firm has initiated a position in Athene Holding during the third quarter of 2020. It is the tenth-largest stock holding in Omega Advisors family office portfolio valued at $33.45 million, accounting for 3.29% of the overall portfolio.

Although Athene shares underperformed in 2020, the stock price recovered strongly in the past three months, thanks to strong organic growth. The company says they are on track to reach a record $50B of total organic and inorganic volumes in 2020.

Meanwhile, other hedge funds remained less bullish about Athene Holding’s performance. The insurance company was in 31 hedge funds’ portfolio at the end of September compared to an all-time high for 50.

Lakewood Capital Management, a fund holding a long position in Athene, commented about the prospects of the insurance company in an investor letter. Here is what Lakewood Capital Management said:

“We previously discussed our long position in Athene Holding in our third quarter 2019 letter, and the stock performed well over the next several months as management continued to execute on its competitively advantaged strategy in retirement services. However, Athene’s stock was punished by the pandemic-related sell-off, and at 60% of tangible book value, we believe it has the potential to double over the next 18 months.”

9. Amazon.com (NASDAQ:AMZN)

The world’s largest e-commerce giant Amazon.com (NASDAQ: AMZN) is the ninth-largest stock holding of the Omega Advisors family office portfolio, accounting for 3.56% of the portfolio. The investment is valued at $36.2 million. Billionaire Lee Cooperman has been holding a position in an e-commerce giant since 2016.

Shares of Amazon rallied almost 80% in the last twelve months, extending the five years gains to 480%. The pandemic-related social distancing policies along with consumer’s shift towards online platforms added to share price gains and financial numbers in the past couple of quarters.

Baron Opportunity Fund, which has generated a 17.92% return in the third quarter, looks optimistic about Amazon. Here’s what Baron Opportunity Fund stated about Amazon in the shareholder’s letter:

“While e-commerce penetration is rising rapidly and Amazon continues to grow its addressable market by entering new verticals, we continue to view Amazon Web Services as the more material driver of the company given its leadership in the vast and growing cloud infrastructure market and potential to compete in application software in the years to come.”

8. Ferro Corporation (NYSE:FOE)

The specialty materials producer and marketer Ferro Corporation (NYSE: FOE) is among the billionaire Lee Cooperman’s favorite stocks heading into 2021. Omega Advisors family office initiated a position in Ferro during the fourth quarter of 2019. Omega has raised its stake in the specialty materials company by 3% in the latest quarter.

Shares of Ferro Corporation recovered sharply in the last three months after experiencing a massive selloff at the beginning of 2020. Its third-quarter revenue fell 33% year over year to $241 million amid pandemic related challenges.

7. Microsoft Corporation (NASDAQ:MSFT)

The technology giant Microsoft Corporation (NASDAQ: MSFT) is the seventh-largest stock holding of Omega Advisors family office portfolio. MSFT stake accounted for 5.08% of the overall portfolio at the end of the latest quarter. The legendary investor has been showing confidence in the technology giant since the fourth quarter of 2015.

Other hedge funds are also bullish on Microsoft. It was in 234 hedge funds’ portfolios at the end of September while the all-time high for this statistics is 235. MSFT ranks #2 among the 30 most popular stocks among hedge funds.

RiverPark Advisors is also bullish on Microsoft and the firm has commented about the tech giant in the shareholder’s letter. Here’s what RiverPark Advisors stated:

“The overall Infrastructure-as-a-Service (IaaS) industry is growing more than 30% per year and is forecast to reach $100 billion of revenues by 2021. We believe that cloud-based services can become the company’s largest revenue and earnings producer and expect Microsoft to generate significant and growing free cash flow ($11 billion last quarter, up 19% year-over-year). The company should deliver at least mid-to-high teens EPS growth, with upside from deploying its $134 billion cash balance ($7 billion was returned to shareholders in the quarter through dividends and share buybacks). We trimmed our position on strength, and Microsoft remains a top-five position in the Fund.”

6. Ashland Global Holdings Inc. (NYSE:ASH)

The specialty chemical provider Ashland Global Holdings Inc. (NYSE: ASH) is the long-running investment of billionaire Lee Cooperman. The firm first initiated a position in Ashland in 2014 while the Cooperman family office added to its existing position in the latest quarter. It is the sixth-largest stock holding of the Omega family office portfolio.

Ashland Global Holdings underperformed in 2020. However, the billionaire investor has bagged significant dividends from the specialty chemical company. It currently offers a dividend yield of 1.40%.

Click to continue reading and see Billionaire Lee Cooperman’s 5 Favorite Stocks Heading Into 2021.

Suggested articles:

- Barry Rosenstein and Jana Partners: Top 10 Stock Picks

- Billionaire Larry Robbins’ Top 10 Stock Picks

- 10 Best Finance Stocks To Buy Now