The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards YY Inc (ADR) (NASDAQ:YY).

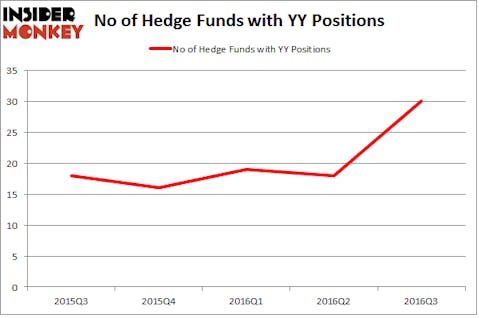

Is YY Inc (ADR) (NASDAQ:YY) ready to rally soon? It looks like prominent investors are taking a bullish view, as the number of bullish hedge fund positions that are disclosed in regulatory 13F filings grew by 12 last quarter. In this way, 30 funds tracked by Insider Monkey amassed shares of YY at the end of September. At the end of this article we will also compare YY to other stocks including Cardtronics, Inc. (NASDAQ:CATM), Box Inc (NYSE:BOX), and 3D Systems Corporation (NYSE:DDD) to get a better sense of its popularity.

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Sergey Nivens/Shutterstock.com

Now, let’s take a look at the latest action surrounding YY Inc (ADR) (NASDAQ:YY).

What have hedge funds been doing with YY Inc (ADR) (NASDAQ:YY)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on YY, up by 67% over the quarter. By comparison, 16 hedge funds held shares or bullish call options in YY heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Gabriel Plotkin’s Melvin Capital Management has the most valuable position in YY Inc (ADR) (NASDAQ:YY), worth close to $73.8 million, accounting for 1.9% of its total 13F portfolio. On Melvin Capital Management’s heels is OZ Management, led by Daniel S. Och, which holds a $60.9 million call position; 0.4% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish comprise Glen Kacher’s Light Street Capital, and Alex Sacerdote’s Whale Rock Capital Management. These funds also rank among investors with the largest new positions in YY as of the end of September. We should also note that two of these hedge funds (Maplelane Capital and Whale Rock Capital Management) are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

On the following page, we are going to take a look at how YY Inc (ADR) (NASDAQ:YY) fares in comparison with other similarly-valued companies.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as YY Inc (ADR) (NASDAQ:YY) but similarly valued. We will take a look at Cardtronics, Inc. (NASDAQ:CATM), Box Inc (NYSE:BOX), 3D Systems Corporation (NYSE:DDD), and Agios Pharmaceuticals Inc (NASDAQ:AGIO). All of these stocks’ market caps resemble YY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CATM | 19 | 61187 | 5 |

| BOX | 20 | 188758 | 7 |

| DDD | 12 | 60704 | 1 |

| AGIO | 19 | 219286 | 8 |

As you can see these stocks had an average of 18 funds with bullish positions and the average amount invested in these stocks was $132 million, which is lower than the $511 million figure in YY’s case. Box Inc (NYSE:BOX) is the most popular stock in this table. On the other hand 3D Systems Corporation (NYSE:DDD) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks YY Inc (ADR) (NASDAQ:YY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

Most Expensive Countries To Buy And Own A Car

High Margin Products To Sell Online

Largest Bodies Of Water In The World

Disclosure: None